Exhibit 99.1

Analyst Day April 22, 2024

Lucas Harper Chief Investment Officer Introduction

Disclaimer 3 This presentation (the “Presentation”) has been prepared by

Innventure, LLC (“Innventure” or the “Company”) and Learn CW Investment Corporation (“Learn CW” or the “SPAC”) in order to assist interested parties in conducting their own evaluation of the potential business combination of the Company and

Learn CW and related transactions (collectively, the “Transaction”). The Presentation does not purport to contain all information that may be required or desired by an interested party in investigating the Company, its business or prospects, or

the proposed business combination, and it shall not be deemed to be a complete description of the state of affairs of the Company historically, at its stated date or in the future. Portions of this Presentation have been prepared based on

information received from the Company, Learn CW and other sources considered reliable; however, neither the Company nor Learn CW have independently verified that such information is correct. None of the Company, Learn CW or any of their

respective affiliates, control persons, officers, directors, employees, representatives or agents make any representation or warranty, express or implied, as to the accuracy, completeness or reliability of the information contained in this

Presentation or any other information provided in conjunction with an evaluation of the Company or the proposed business combination. Only those particular representations and warranties that may be made in relation to any legally binding

written definitive agreement signed by the parties relating to the Transaction, and subject to such limitations and restrictions as may be agreed upon, shall have any legal effect. Conditions and information reported in the Presentation may

change without any notice, and Learn CW, the Company and their respective affiliates and related persons disclaim any responsibility or liability to update the information contained in this Presentation except to the extent required by

applicable law or regulation. In addition, all of the market data included in this Presentation involves a number of assumptions, limitations, projections, estimates and research. Such market data is necessarily subject to a high degree of

uncertainty and risk and there can be no guarantee as to the accuracy or reliability of such assumptions. Caution Regarding Forward-Looking Information This Presentation contains forward-looking statements, including statements about the

parties’ ability to close the business combination, the anticipated benefits of the business combination, and the financial condition, results of operations, earnings outlook and prospects of Learn CW and/or Innventure and may include

statements for the period following the consummation of the business combination, including revenue growth and financial performance. Forward-looking statements appear in a number of places in this Presentation. In addition, any statements that

refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. Forward-looking statements are typically identified by words such as “plan,”

“believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “continue,” “could,” “may,” “might,” “possible,” “potential,” “predict,” “should,” “would” and other similar words and expressions, but the absence of

these words does not mean that a statement is not forward-looking. These forward-looking statements are based on the current expectations and beliefs of the management of Learn CW and Innventure in light of their respective experience and

their perception of historical trends, current conditions and expected future developments and their potential effects on Learn CW, Innventure and Holdco as well as other factors they believe are appropriate in the circumstances. There can be

no assurance that future developments affecting Learn CW, Innventure or Holdco will be those that we have anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond the control of the

parties) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements, including those discussed and identified in the public filings made or to

be made with the SEC by Learn CW, including in the final prospectus relating to Learn CW’s IPO, which was filed with the SEC on October 12, 2021 under the heading “Risk Factors,” or made or to be made by Holdco upon closing of the Transaction,

and the following:

Disclaimer 4 expectations regarding Innventure’s and the Innventure Companies’

strategies and future financial performance, including their future business plans, expansion and acquisition plans or objectives, prospective performance and opportunities and competitors, revenues, products and services, pricing, operating

expenses, product and service acceptance, market trends, liquidity, cash flows and uses of cash, capital expenditures, and Innventure’s ability to invest in growth initiatives; the implementation, market acceptance and success of Innventure’s

business model and growth strategy; the implementation, market acceptance and success of the Innventure Companies’ business models and growth strategies; that Innventure will have sufficient capital upon the approval of the proposed business

combination to operate as anticipated; Innventure’s future capital requirements and sources and uses of cash; Innventure’s ability to obtain funding for its operations and future growth; developments and projections relating to Innventure’s

and the Innventure Companies’ competitors and industries; the Innventure Companies’ ability to meet, and to continue to meet, applicable regulatory requirements for the use of their products, including in food grade applications; the

Innventure Companies’ ability to comply on an ongoing basis with the numerous regulatory requirements applicable to their products and facilities; the occurrence of any event, change or other circumstances that could give rise to the

termination of the proposed business combination agreement; the outcome of any legal proceedings that may be instituted against Learn CW or Innventure following announcement of the proposed business combination agreement and the transactions

contemplated therein; the inability to complete the proposed business combination due to, among other things, the failure to obtain the required Learn CW shareholder approval; regulatory approvals; the risk that the announcement and

consummation of the proposed business combination disrupts Innventure’s current plans; the ability to recognize the anticipated benefits of the proposed business combination; unexpected costs related to the proposed business combination; the

amount of any redemptions by existing holders of Learn CW’s common stock being greater than expected; limited liquidity and trading of Learn CW’s securities; geopolitical risk and changes in applicable laws or regulations;

Disclaimer 5 the possibility that Learn CW and/or Innventure may be adversely

affected by other economic, business, and/or competitive factors; the potential characterization of Innventure as an investment company subject to the Investment Company Act of 1940; operational risk; and the risk that the consummation of

the proposed business combination is substantially delayed or does not occur. Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may vary in material respects from

those projected in these forward- looking statements. All subsequent written and oral forward-looking statements concerning the business combination or other matters addressed in this Presentation and attributable to Learn CW, Innventure, or

any person acting on their behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this proxy statement. Except to the extent required by applicable law or regulation, Learn CW and Innventure

undertake no obligation to update these forward-looking statements to reflect events or circumstances after the date of this Presentation or to reflect the occurrence of unanticipated events. Market and Industry Data Certain market, industry

and other data used herein have been obtained or derived from third-party sources and publications as well as from research reports prepared for other purposes. Although the information from these third-party sources is believed to be reliable,

none of the Company or its management has independently verified the data obtained from these sources, and no assurances can be made regarding the accuracy or completeness of such data. Forecasts and other forward-looking information obtained

from these sources are subject to the same qualifications and the additional uncertainties regarding the other forward-looking statements contained herein.

Disclaimer 6 Trademarks In addition to trademarks, service marks, trade names,

copyrights and logos of Innventure and its subsidiaries contained herein, this presentation contains trademarks, service marks, trade names, copyrights and logos of other companies, which are the property of their respective owners. Unless

otherwise stated, the use of these other trademarks, service marks, trade names, copyrights and logos herein does not imply an affiliation with, or endorsement of the information contained herein by, the owners of such trademarks, service

marks, trade names, copyrights and logos. Additional Information About the Proposed Business Combination and Where To Find It In connection with the proposed business combination, Learn SPAC Holdco, Inc. has filed with the SEC a registration

statement on Form S-4 containing a preliminary proxy statement of Learn CW, a preliminary consent solicitation statement of Innventure and a preliminary prospectus with respect to the combined company’s securities to be issued in connection

with the business combination, and after the registration statement is declared effective, the definitive proxy statement/consent solicitation statement/prospectus relating to the proposed business combination will be mailed to Learn CW

shareholders and will be sent to Innventure unitholders. This presentation does not contain all the information that should be considered concerning the proposed business combination and is not intended to form the basis of any investment

decision or any other decision in respect of the business combination. Learn CW’s shareholders, Innventure’s unitholders and other interested persons are urged to read the preliminary proxy statement/consent solicitation statement/prospectus

and the amendments thereto and, when available, the definitive proxy statement/consent solicitation statement/prospectus and other documents filed in connection with the proposed business combination, as these materials will contain important

information about Innventure, Learn CW, the combined company and the proposed business combination. When available, the definitive proxy statement/consent solicitation statement/prospectus and other relevant materials for the proposed business

combination will be mailed to shareholders of Learn CW as of a record date to be established for voting on the proposed business combination. Such shareholders will also be able to obtain copies of the preliminary and definitive proxy

statement/consent solicitation statement/prospectus and other documents filed with the SEC, without charge, once available, at the SEC’s website at www.sec.gov, or by directing a request to Learn CW Investment Corporation, 11755 Wilshire Blvd.,

Suite 2320, Los Angeles, California 90025. No Offer or Solicitation This presentation shall not constitute an offer to sell or the solicitation of an offer to buy any securities, or a solicitation of any vote or approval, nor shall there be

any sale of any such securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction. No offer of securities

shall be made except by means of a definitive document. Participants in the Solicitation Innventure, Learn CW and their respective directors, executive officers, other members of management, and employees, under SEC rules, may be deemed to be

participants in the solicitation of proxies of Learn CW’s shareholders in connection with the proposed business combination. Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of Learn CW’s

shareholders in connection with the proposed business combination are set forth in the registration statement on Form S-4, including the preliminary proxy statement/consent solicitation statement/prospectus, and will also be set forth in the

definitive proxy statement/consent solicitation statement/prospectus when available. Investors and security holders may obtain more detailed information regarding the names and interests in the proposed business combination of Learn CW’s

directors and officers in Learn CW’s filings with the SEC and such information is also set forth in the registration statement filed with the SEC by Learn SPAC Holdco, Inc., including the proxy statement of Learn CW for the proposed business

combination.

9:00am Welcome & Opening remarks Lucas Harper, Chief Investment

Officer 9:05am What is Innventure? Bill Haskell, Chief Executive Officer 9:30am Strategic Partnerships Tom Cripe, Head of Strategic Partnerships 9:45am DownSelect® Colin Scott, Vice President, Head of

DownSelect® 10:15am Break 10:30am NewCo Presentations AeroFlexx Accelsius Andy Meyer, Chief Executive Officer Josh Claman, Chief Executive Officer 11:00am Financial Model & Valuation Dave Yablunosky, Chief Financial Officer Lucas

Harper, Chief Investment Officer Roland Austrup, Capital Markets 11:30am Q&A 7 Innventure Analyst Day 2024 Agenda

Leadership – Executive Committee 8 Bill Haskell – Chief Executive Officer Bill

serves as Chief Executive Officer for Innventure. Previously, he was a co-founder and President of XL TechGroup that created the foundational business building methodology upon which Innventure is based. Bill has worked with the key principals

of Innventure for over 20 years. He has also served as a public company CEO and has been a director of over a dozen private and public companies. Prior to joining Innventure in 2021, Bill was a partner at a boutique investment bank focused on

converting private companies into employee-owned enterprises. He has over 30 years of experience in company creation and development. In addition to being a Director of Innventure, Bill serves as Chairman of Accelsius and is a Director of

AeroFlexx – two partnership companies created by Innventure. Bill holds a B.S. degree in engineering and conducted post graduate work in applied mathematics at Iowa State University. David Yablunosky – Chief Financial Officer David’s finance

career spans over 30+ years with large public and private multinational corporations. Prior to Innventure, David was Chief Financial Officer of Embraer Aircraft Holding, Inc., the U.S. subsidiary of the Brazilian aerospace and defense

conglomerate Embraer, SA. He was also CFO and Board Member of Embraer Executive Aircraft, Inc., and Board Member of Embraer Defense and Security, Inc. Over his career David has worked for large MNCs such as Ford Motor Company, Ford Credit,

Office Depot, Oxbow Carbon LLC, and Embraer. Before his career in finance, David served nine years in the U.S. Navy and worked in the Pentagon on General Colin Powell’s staff. David holds a B.S. in Mathematics from the U.S. Naval Academy and an

MBA in Finance from the University of Maryland. He also holds a graduate-level certificate in Accounting from the Harvard University Extension School and has completed the Advanced Management Program at the Harvard Business School. Dr. John

Scott – Co-founder, Strategy John is an Innventure Co-founder, member of the Investment Committee, and serves in a strategy role at Innventure. Prior to co-founding Innventure, John served as Founder and CEO of XL TechGroup where he developed

the DownSelect Method that Innventure uses today to vet disruptive technologies from top Multinational Corporations (MNCs) and their associated business opportunities. John also served as an academic scientist at numerous universities and

government labs including the Universities of Maryland, North Carolina and Arizona, as well as the NASA Goddard Space Flight Center. He earned his Ph.D. in Physics and Astrophysics from the University of Arizona and has published over 60

academic papers. Mike Otworth – Co-founder, Executive Chairman, International Mike is an Innventure Co-founder and currently serves as Executive Chairman of the Board and in an international role at Innventure. Mike was the Founding CEO and

Chairman of the Board of PureCycle (PCT), an Innventure Company, from 2015-2022. Mike and team took PCT from early- stage concept to operational pilot, fully funded first commercial plant, followed by a successful public offering in March of

2021. Prior to Innventure, Mike served as President and Founding Partner of Green Ocean Innovation for six years a company that provided technology sourcing, innovation strategy, and development services to Lilly/Elanco Animal Health. Mike also

served as Vice- President and Founding CEO of multiple start-ups at XL TechGroup. Mike began his career on Capitol Hill working as a legislative aide and committee staff member in the U.S. House of Representatives. Roland Austrup – Capital

Markets In addition to his Innventure role, Roland serves as Chairman of WaveFront Global Asset Management Corp., a Toronto-based global hedge fund company he co-founded in 2003. Roland is also a founding Director of Envest Corp., a downstream

energy company, and an Advisory Board member of both the Master of Quantitative Finance program at the University of Waterloo and First Tracks Capital, a Canadian private equity firm. Roland was an Investment Advisor with BMO Nesbitt Burns Inc.

and began his career as a Commodities Broker with ScotiaMcLeod Inc., hedging commodity price risk for corporate clients. Roland holds a B.A. with Honors from the University of Western Ontario.

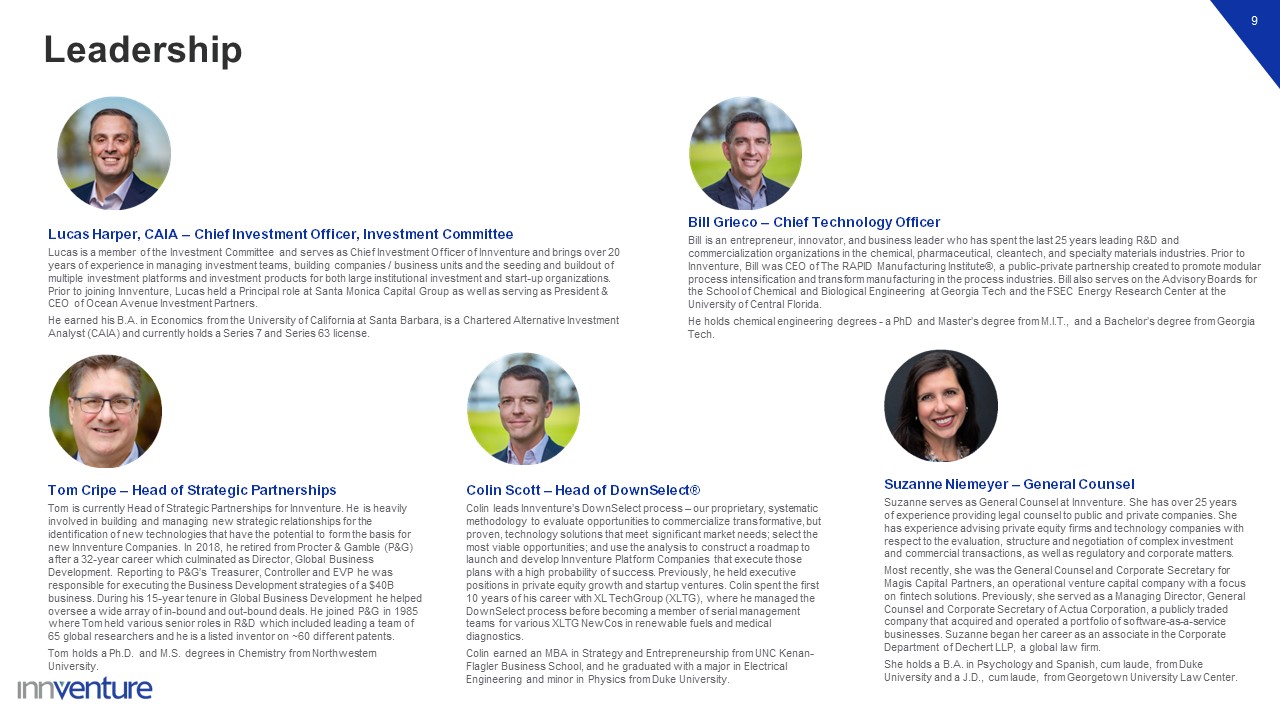

Lucas Harper, CAIA – Chief Investment Officer, Investment Committee Lucas is a

member of the Investment Committee and serves as Chief Investment Officer of Innventure and brings over 20 years of experience in managing investment teams, building companies / business units and the seeding and buildout of multiple investment

platforms and investment products for both large institutional investment and start-up organizations. Prior to joining Innventure, Lucas held a Principal role at Santa Monica Capital Group as well as serving as President & CEO of Ocean

Avenue Investment Partners. He earned his B.A. in Economics from the University of California at Santa Barbara, is a Chartered Alternative Investment Analyst (CAIA) and currently holds a Series 7 and Series 63 license. Bill Grieco – Chief

Technology Officer Bill is an entrepreneur, innovator, and business leader who has spent the last 25 years leading R&D and commercialization organizations in the chemical, pharmaceutical, cleantech, and specialty materials industries.

Prior to Innventure, Bill was CEO of The RAPID Manufacturing Institute®, a public-private partnership created to promote modular process intensification and transform manufacturing in the process industries. Bill also serves on the Advisory

Boards for the School of Chemical and Biological Engineering at Georgia Tech and the FSEC Energy Research Center at the University of Central Florida. He holds chemical engineering degrees - a PhD and Master’s degree from M.I.T., and a

Bachelor’s degree from Georgia Tech. 9 Tom Cripe – Head of Strategic Partnerships Tom is currently Head of Strategic Partnerships for Innventure. He is heavily involved in building and managing new strategic relationships for the

identification of new technologies that have the potential to form the basis for new Innventure Companies. In 2018, he retired from Procter & Gamble (P&G) after a 32-year career which culminated as Director, Global Business Development.

Reporting to P&G’s Treasurer, Controller and EVP he was responsible for executing the Business Development strategies of a $40B business. During his 15-year tenure in Global Business Development he helped oversee a wide array of in-bound

and out-bound deals. He joined P&G in 1985 where Tom held various senior roles in R&D which included leading a team of 65 global researchers and he is a listed inventor on ~60 different patents. Tom holds a Ph.D. and M.S. degrees in

Chemistry from Northwestern University. Leadership Suzanne Niemeyer – General Counsel Suzanne serves as General Counsel at Innventure. She has over 25 years of experience providing legal counsel to public and private companies. She has

experience advising private equity firms and technology companies with respect to the evaluation, structure and negotiation of complex investment and commercial transactions, as well as regulatory and corporate matters. Most recently, she was

the General Counsel and Corporate Secretary for Magis Capital Partners, an operational venture capital company with a focus on fintech solutions. Previously, she served as a Managing Director, General Counsel and Corporate Secretary of Actua

Corporation, a publicly traded company that acquired and operated a portfolio of software-as-a-service businesses. Suzanne began her career as an associate in the Corporate Department of Dechert LLP, a global law firm. She holds a B.A. in

Psychology and Spanish, cum laude, from Duke University and a J.D., cum laude, from Georgetown University Law Center. Colin Scott – Head of DownSelect® Colin leads Innventure’s DownSelect process – our proprietary, systematic methodology to

evaluate opportunities to commercialize transformative, but proven, technology solutions that meet significant market needs; select the most viable opportunities; and use the analysis to construct a roadmap to launch and develop Innventure

Platform Companies that execute those plans with a high probability of success. Previously, he held executive positions in private equity growth and startup ventures. Colin spent the first 10 years of his career with XL TechGroup (XLTG), where

he managed the DownSelect process before becoming a member of serial management teams for various XLTG NewCos in renewable fuels and medical diagnostics. Colin earned an MBA in Strategy and Entrepreneurship from UNC Kenan- Flagler Business

School, and he graduated with a major in Electrical Engineering and minor in Physics from Duke University.

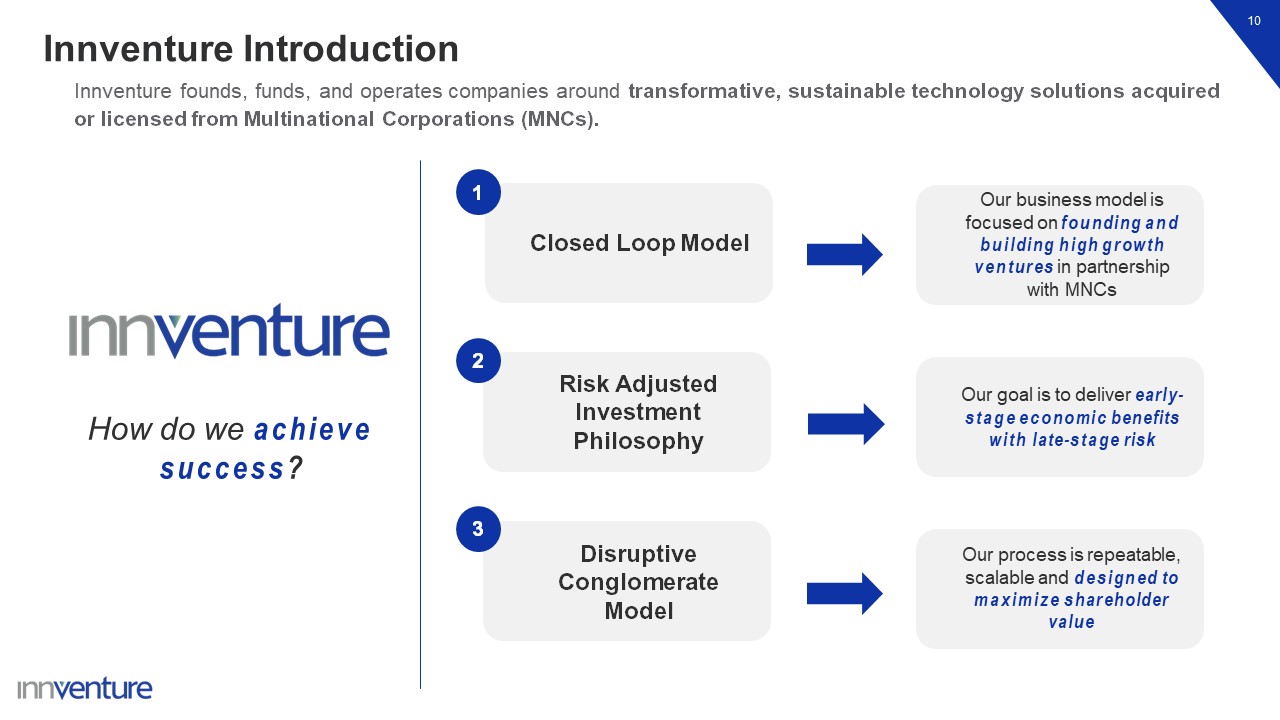

10 Innventure Introduction Innventure founds, funds, and operates companies

around transformative, sustainable technology solutions acquired or licensed from Multinational Corporations (MNCs). Disruptive Conglomerate Model Risk Adjusted Investment Philosophy Closed Loop Model 1 2 3 Our business model is focused

on founding and building high growth ventures in partnership with MNCs Our goal is to deliver early- stage economic benefits with late-stage risk Our process is repeatable, scalable and designed to maximize shareholder value How do we

achieve success?

Bill Haskell Chief Executive Officer Company Overview

What is Innventure’s Core Mission? We intend to transform how multinational

corporations monetize their best technologies

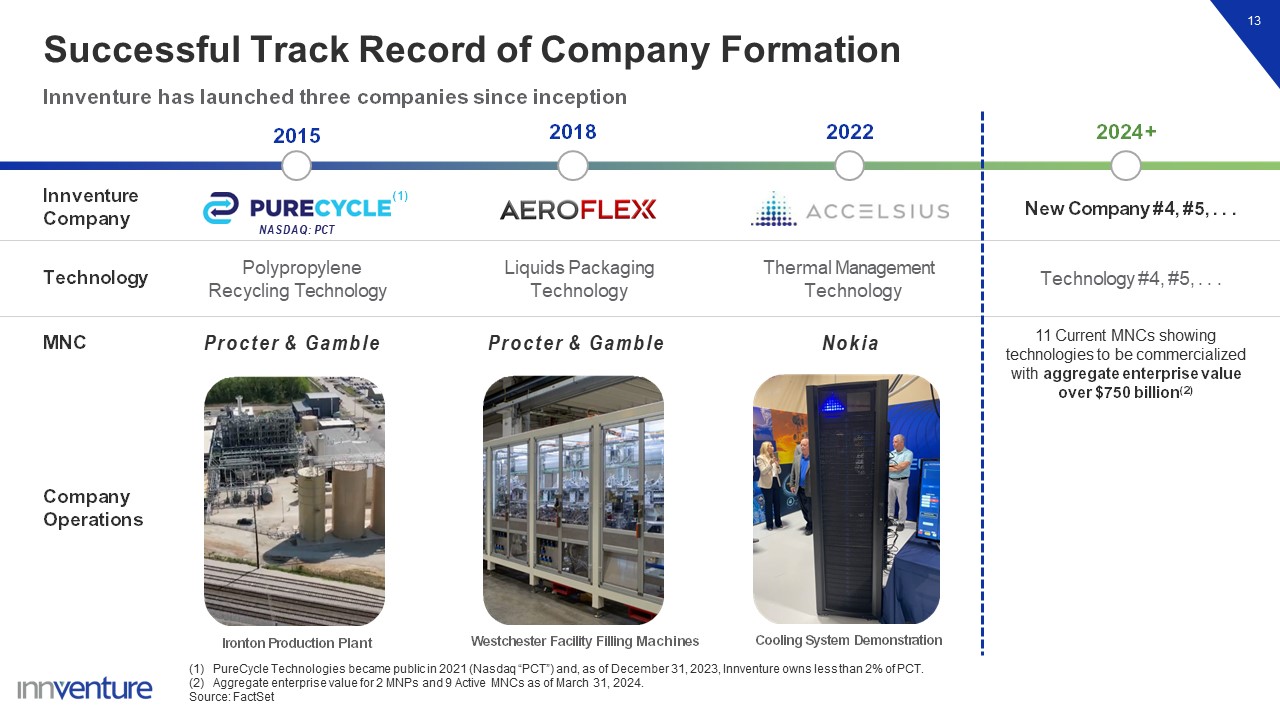

13 2015 2018 2022 2024+ Innventure Company New Company #4, #5, . .

. Technology Polypropylene Recycling Technology Liquids Packaging Technology Thermal Management Technology Technology #4, #5, . . . MNC 11 Current MNCs showing technologies to be commercialized with aggregate enterprise value over $750

billion(2) Innventure has launched three companies since inception Procter & Gamble Nokia Procter & Gamble PureCycle Technologies became public in 2021 (Nasdaq “PCT”) and, as of December 31, 2023, Innventure owns less than 2% of

PCT. Aggregate enterprise value for 2 MNPs and 9 Active MNCs as of March 31, 2024. Source: FactSet NASDAQ: PCT (1) Successful Track Record of Company Formation Company Operations Ironton Production Plant Westchester Facility Filling

Machines Cooling System Demonstration

Innventure’s business model was designed to mitigate five of the key risks

historically inherent in high- growth venture creation Innventure – Achieving Our Core Mission 14 Operational Execution Funding Adoption Technology Macro/Market Level 1 2 3 4 5 Key Risks in Company Creation

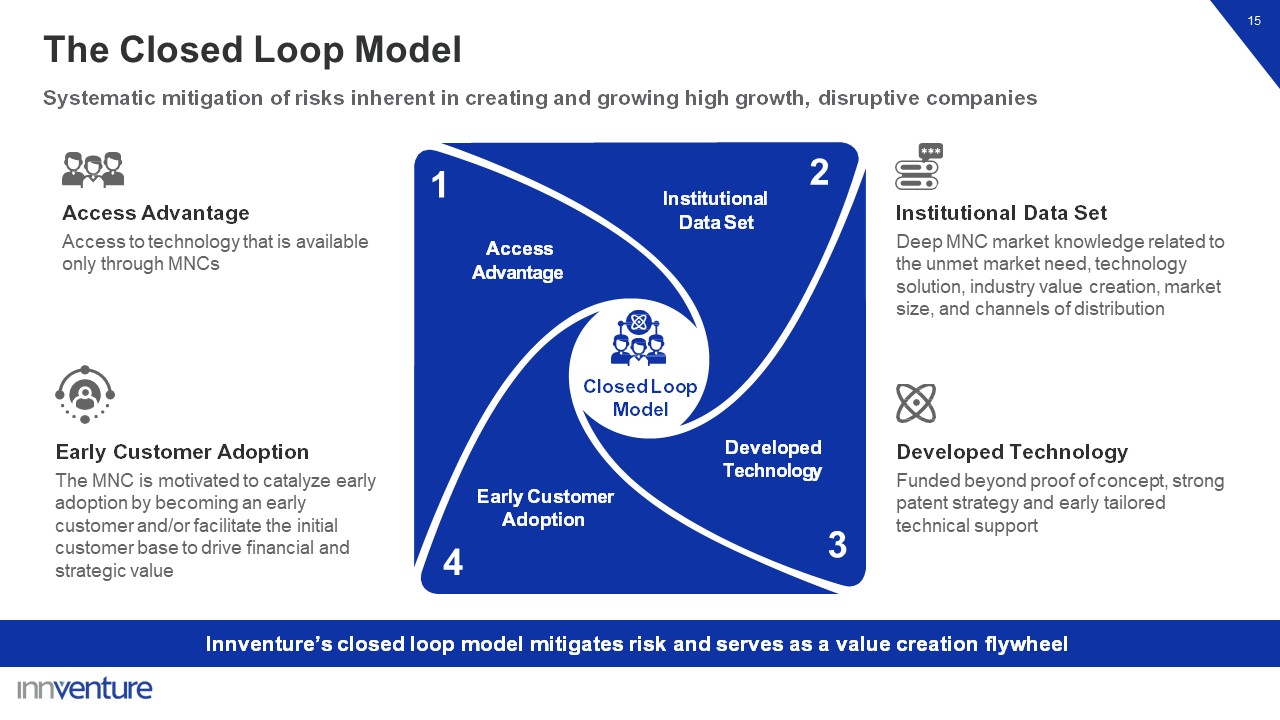

15 Systematic mitigation of risks inherent in creating and growing high growth,

disruptive companies Institutional Data Set Developed Technology Early Customer Adoption Access Advantage Institutional Data Set Deep MNC market knowledge related to the unmet market need, technology solution, industry value creation,

market size, and channels of distribution Access Advantage Access to technology that is available only through MNCs Early Customer Adoption The MNC is motivated to catalyze early adoption by becoming an early customer and/or facilitate the

initial customer base to drive financial and strategic value Developed Technology Funded beyond proof of concept, strong patent strategy and early tailored technical support Innventure’s closed loop model mitigates risk and serves as a value

creation flywheel Closed Loop Model The Closed Loop Model 1 2 3 4

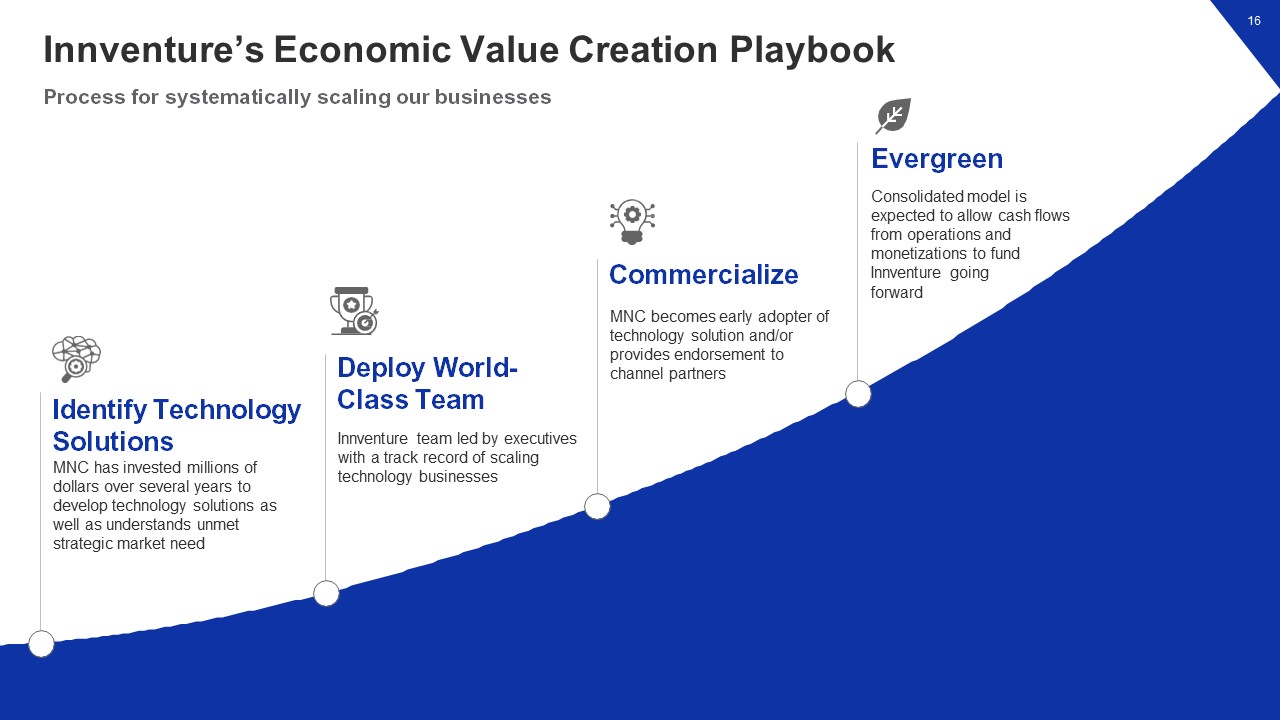

Process for systematically scaling our businesses Identify Technology

Solutions MNC has invested millions of dollars over several years to develop technology solutions as well as understands unmet strategic market need Deploy World- Class Team Innventure team led by executives with a track record of scaling

technology businesses Commercialize MNC becomes early adopter of technology solution and/or provides endorsement to channel partners Evergreen Consolidated model is expected to allow cash flows from operations and monetizations to fund

Innventure going forward 16 Innventure’s Economic Value Creation Playbook

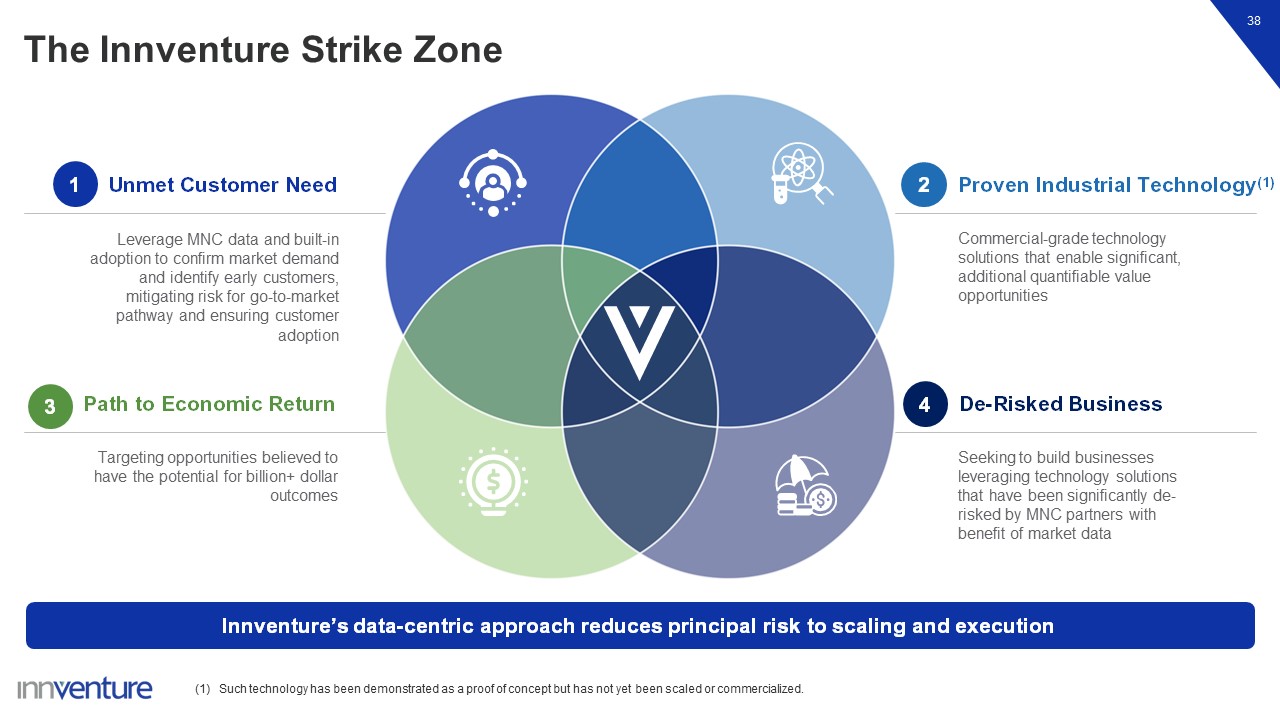

Commercial-grade technology solutions that enable significant, additional

quantifiable value opportunities Seeking to build businesses leveraging technology solutions that have been significantly de- risked by MNC partners with benefit of market data Leverage MNC data and built-in adoption to confirm market demand

and identify early customers, mitigating risk for go-to-market pathway and ensuring customer adoption Targeting opportunities believed to have the potential for billion+ dollar outcomes Path to Economic Return The Innventure Strike

Zone 17 Innventure’s data-centric approach reduces principal risk to scaling and execution (1) Such technology has been demonstrated as a proof of concept but has not yet been scaled or commercialized. De-Risked Business 1 Unmet Customer

Need 2 Proven Industrial Technology(1) 3 4

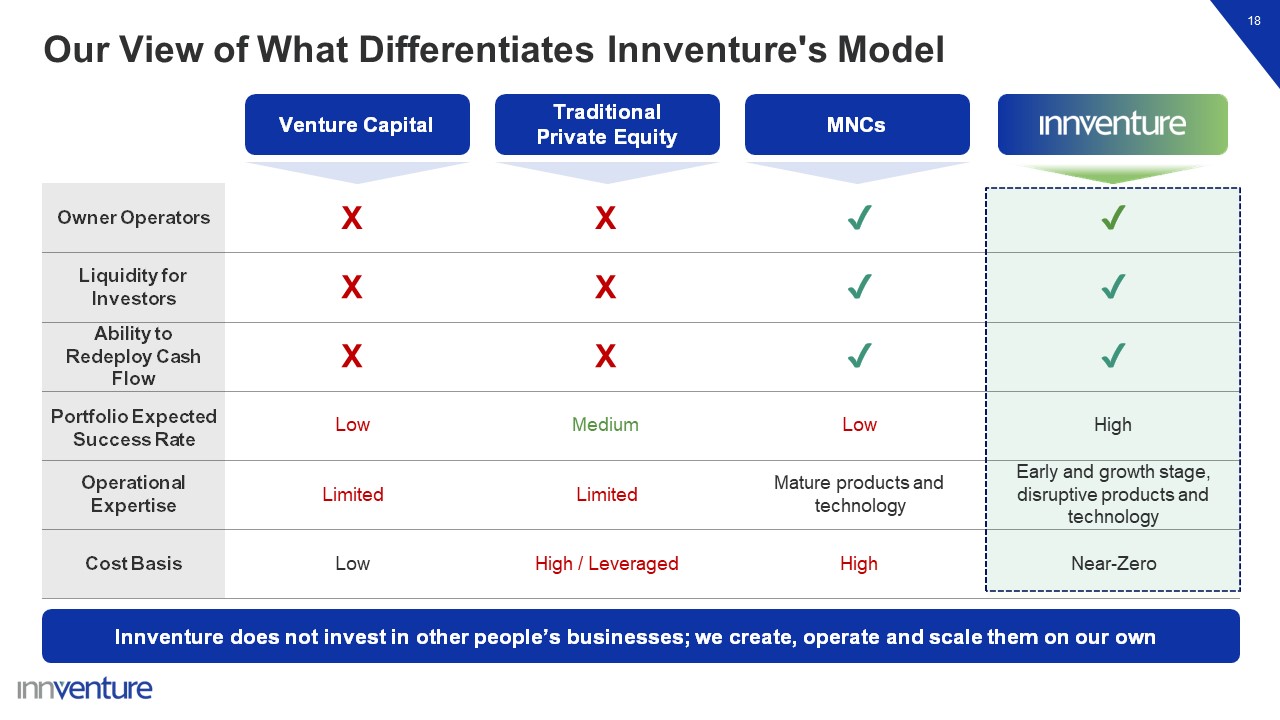

Owner Operators X X ✔ ✔ Liquidity for Investors X X ✔ ✔ Ability to

Redeploy Cash Flow X X ✔ ✔ Portfolio Expected Success Rate Low Medium Low High Operational Expertise Limited Limited Mature products and technology Early and growth stage, disruptive products and technology Cost Basis Low High

/ Leveraged High Near-Zero 18 Venture Capital Traditional Private Equity MNCs Innventure does not invest in other people’s businesses; we create, operate and scale them on our own Our View of What Differentiates Innventure's Model

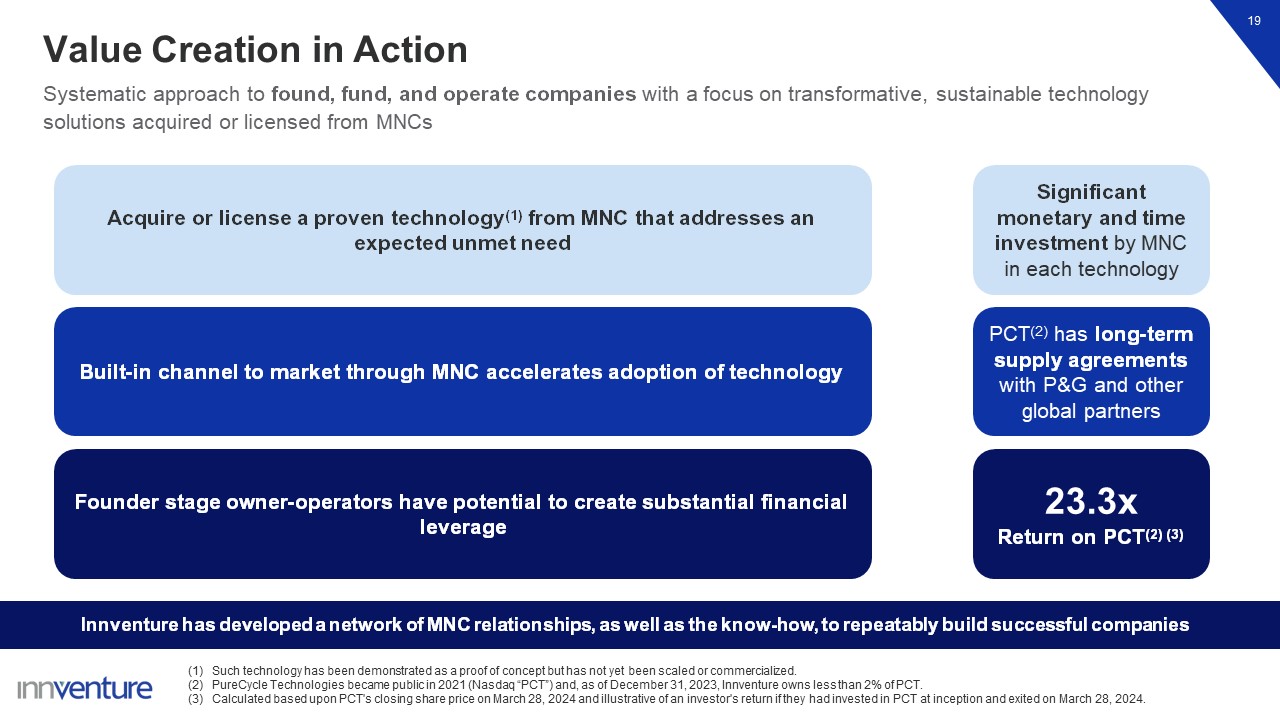

19 Acquire or license a proven technology(1) from MNC that addresses an expected

unmet need Built-in channel to market through MNC accelerates adoption of technology Founder stage owner-operators have potential to create substantial financial leverage Significant monetary and time investment by MNC in each

technology PCT(2) has long-term supply agreements with P&G and other global partners 23.3x Return on PCT(2) (3) Systematic approach to found, fund, and operate companies with a focus on transformative, sustainable technology solutions

acquired or licensed from MNCs Innventure has developed a network of MNC relationships, as well as the know-how, to repeatably build successful companies Such technology has been demonstrated as a proof of concept but has not yet been scaled

or commercialized. PureCycle Technologies became public in 2021 (Nasdaq “PCT”) and, as of December 31, 2023, Innventure owns less than 2% of PCT. Calculated based upon PCT's closing share price on March 28, 2024 and illustrative of an

investor's return if they had invested in PCT at inception and exited on March 28, 2024. Value Creation in Action

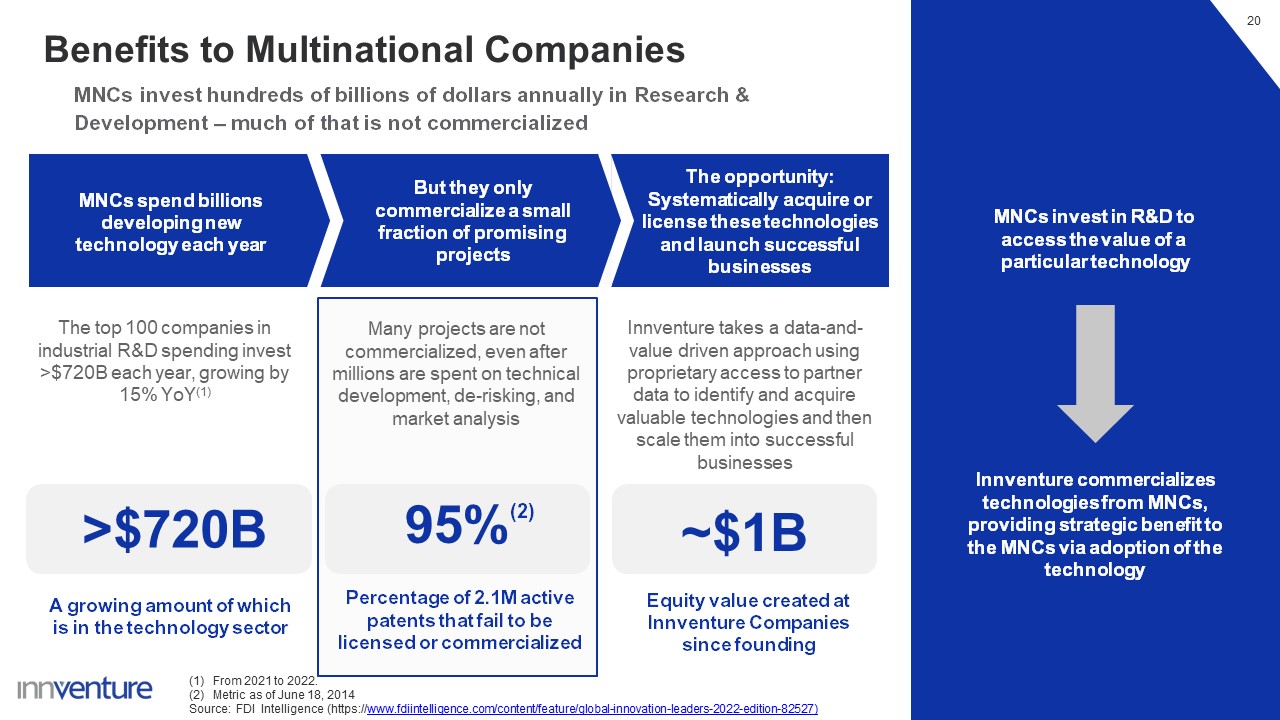

20 Benefits to Multinational Companies MNCs invest hundreds of billions of

dollars annually in Research & Development – much of that is not commercialized From 2021 to 2022. Metric as of June 18, 2014 Source: FDI Intelligence

(https://www.fdiintelligence.com/content/feature/global-innovation-leaders-2022-edition-82527) MNCs invest in R&D to access the value of a particular technology Innventure commercializes technologies from MNCs, providing strategic benefit

to the MNCs via adoption of the technology The top 100 companies in industrial R&D spending invest >$720B each year, growing by 15% YoY(1) >$720B A growing amount of which is in the technology sector The opportunity:

Systematically acquire or license these technologies and launch successful businesses But they only commercialize a small fraction of promising projects MNCs spend billions developing new technology each year Many projects are not

commercialized, even after millions are spent on technical development, de-risking, and market analysis 95%(2) Percentage of 2.1M active patents that fail to be licensed or commercialized Innventure takes a data-and- value driven approach

using proprietary access to partner data to identify and acquire valuable technologies and then scale them into successful businesses ~$1B Equity value created at Innventure Companies since founding

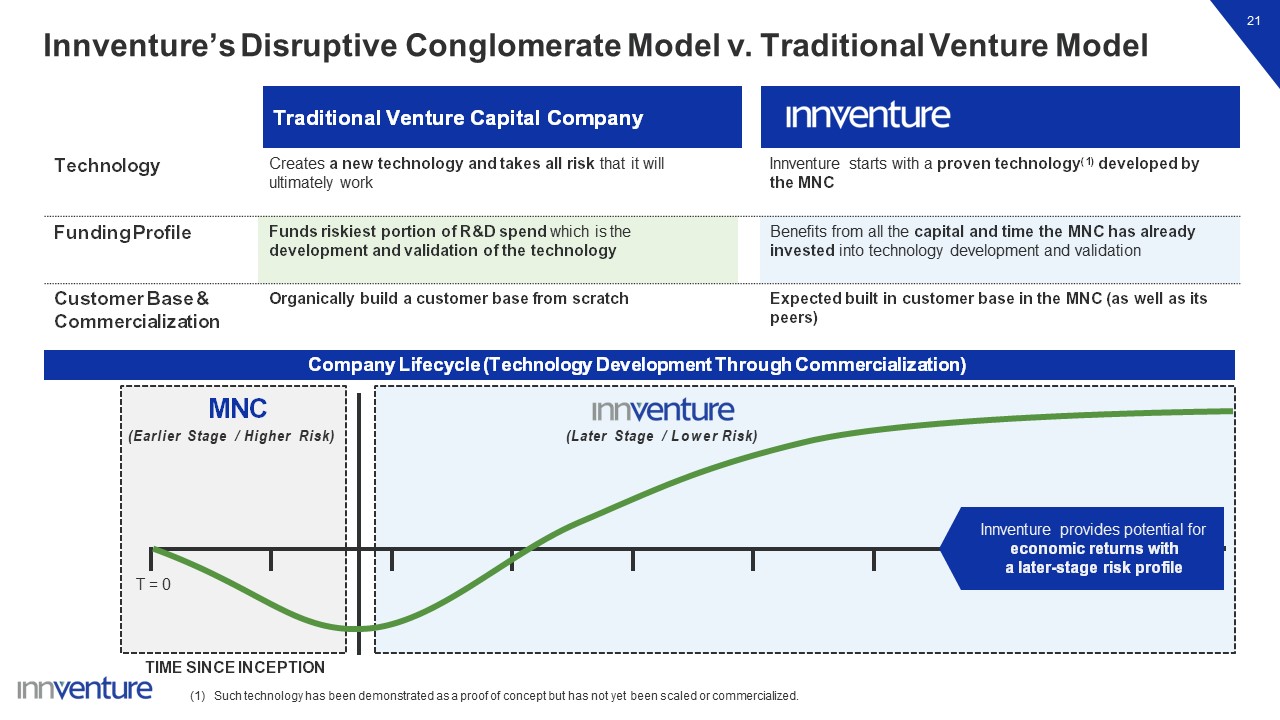

21 Technology Creates a new technology and takes all risk that it

will ultimately work Innventure starts with a proven technology(1) developed by the MNC Funding Profile Funds riskiest portion of R&D spend which is the development and validation of the technology Benefits from all the capital and

time the MNC has already invested into technology development and validation Customer Base & Commercialization Organically build a customer base from scratch Expected built in customer base in the MNC (as well as its peers) Company

Lifecycle (Technology Development Through Commercialization) Traditional Venture Capital Company MNC (Earlier Stage / Higher Risk) (Later Stage / Lower Risk) Innventure provides potential for economic returns with a later-stage risk

profile T = 0 TIME SINCE INCEPTION (1) Such technology has been demonstrated as a proof of concept but has not yet been scaled or commercialized. Innventure’s Disruptive Conglomerate Model v. Traditional Venture Model

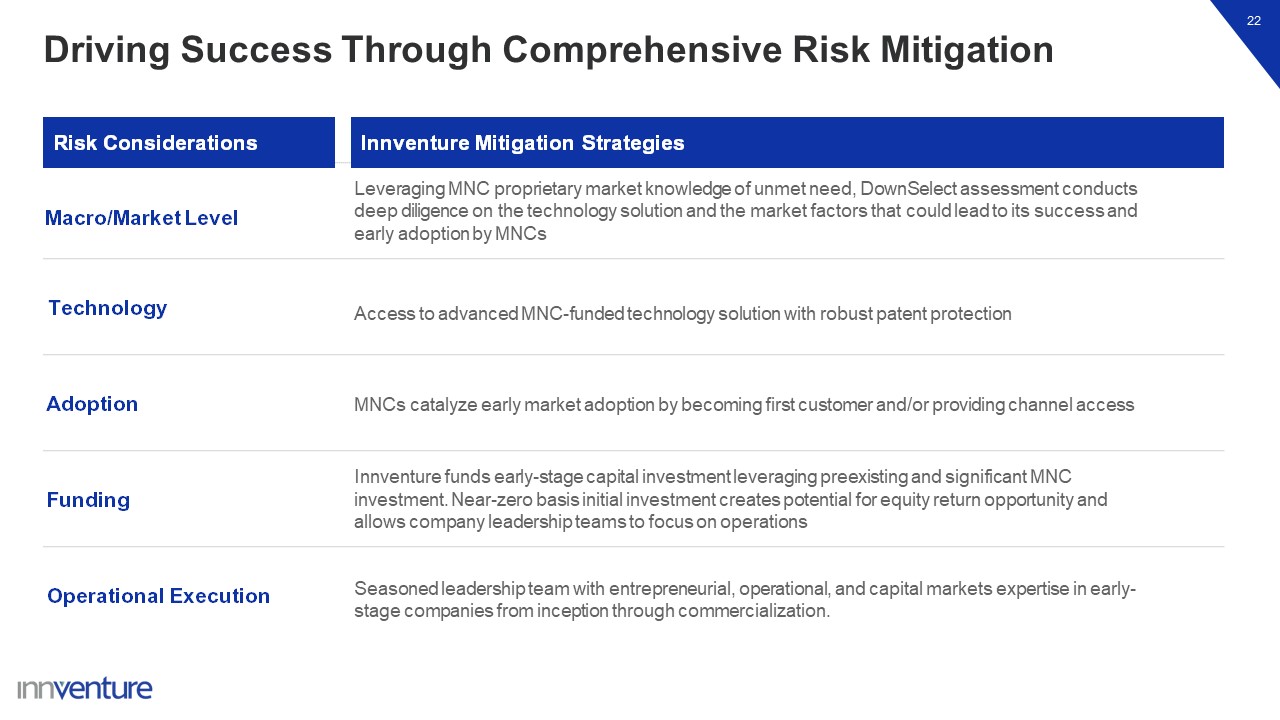

22 Macro/Market Level Leveraging MNC proprietary market knowledge of unmet need,

DownSelect assessment conducts deep diligence on the technology solution and the market factors that could lead to its success and early adoption by MNCs Technology Access to advanced MNC-funded technology solution with robust patent

protection Adoption MNCs catalyze early market adoption by becoming first customer and/or providing channel access Funding Innventure funds early-stage capital investment leveraging preexisting and significant MNC investment. Near-zero

basis initial investment creates potential for equity return opportunity and allows company leadership teams to focus on operations Operational Execution Seasoned leadership team with entrepreneurial, operational, and capital markets

expertise in early- stage companies from inception through commercialization. Risk Considerations Innventure Mitigation Strategies Driving Success Through Comprehensive Risk Mitigation

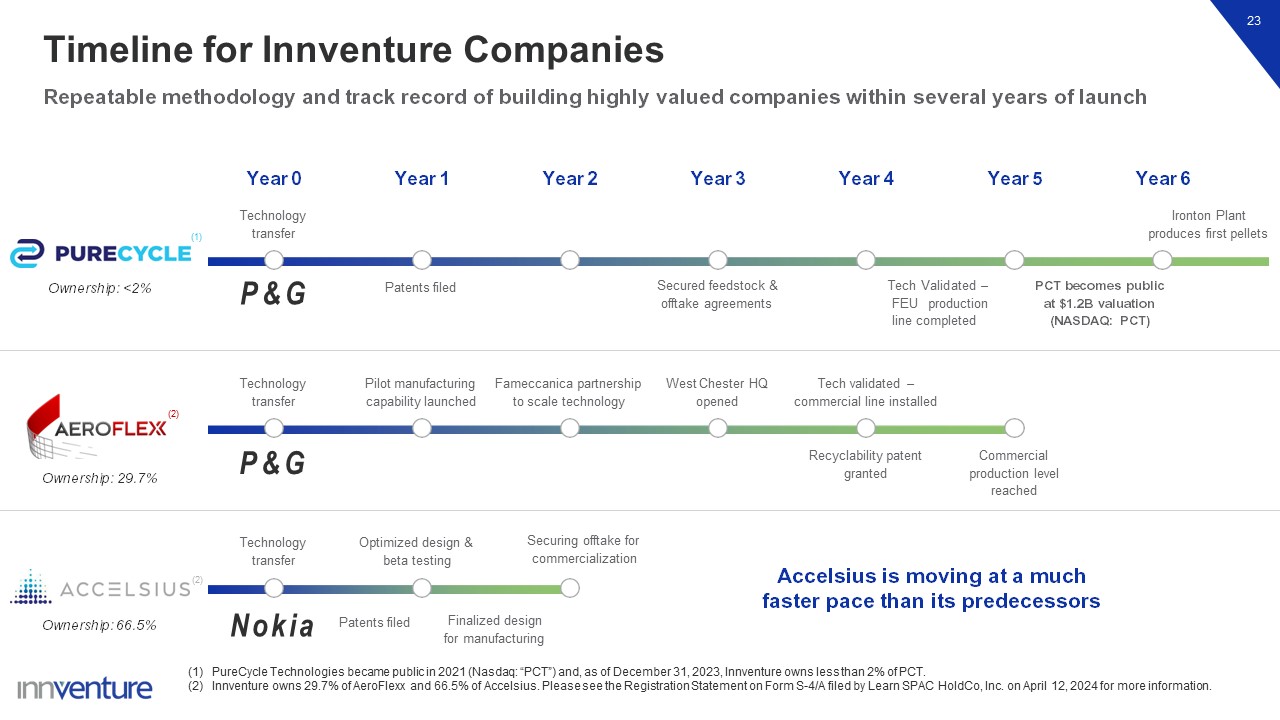

23 Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Technology

transfer Patents filed Secured feedstock & offtake agreements Tech Validated – FEU production line completed PCT becomes public at $1.2B valuation (NASDAQ: PCT) Ironton Plant produces first pellets Ownership: <2% Ownership:

29.7% Ownership: 66.5% Technology transfer Fameccanica partnership to scale technology Recyclability patent granted West Chester HQ opened Tech validated – commercial line installed Commercial production level reached Technology

transfer Accelsius is moving at a much faster pace than its predecessors Patents filed Optimized design & beta testing Finalized design for manufacturing Securing offtake for commercialization Repeatable methodology and track record

of building highly valued companies within several years of launch Pilot manufacturing capability launched P&G P&G Nokia PureCycle Technologies became public in 2021 (Nasdaq: “PCT”) and, as of December 31, 2023, Innventure owns

less than 2% of PCT. Innventure owns 29.7% of AeroFlexx and 66.5% of Accelsius. Please see the Registration Statement on Form S-4/A filed by Learn SPAC HoldCo, Inc. on April 12, 2024 for more information. (2) (2) (1) Timeline for

Innventure Companies

Tom Cripe Head of Strategic Partnerships Strategic Partnerships

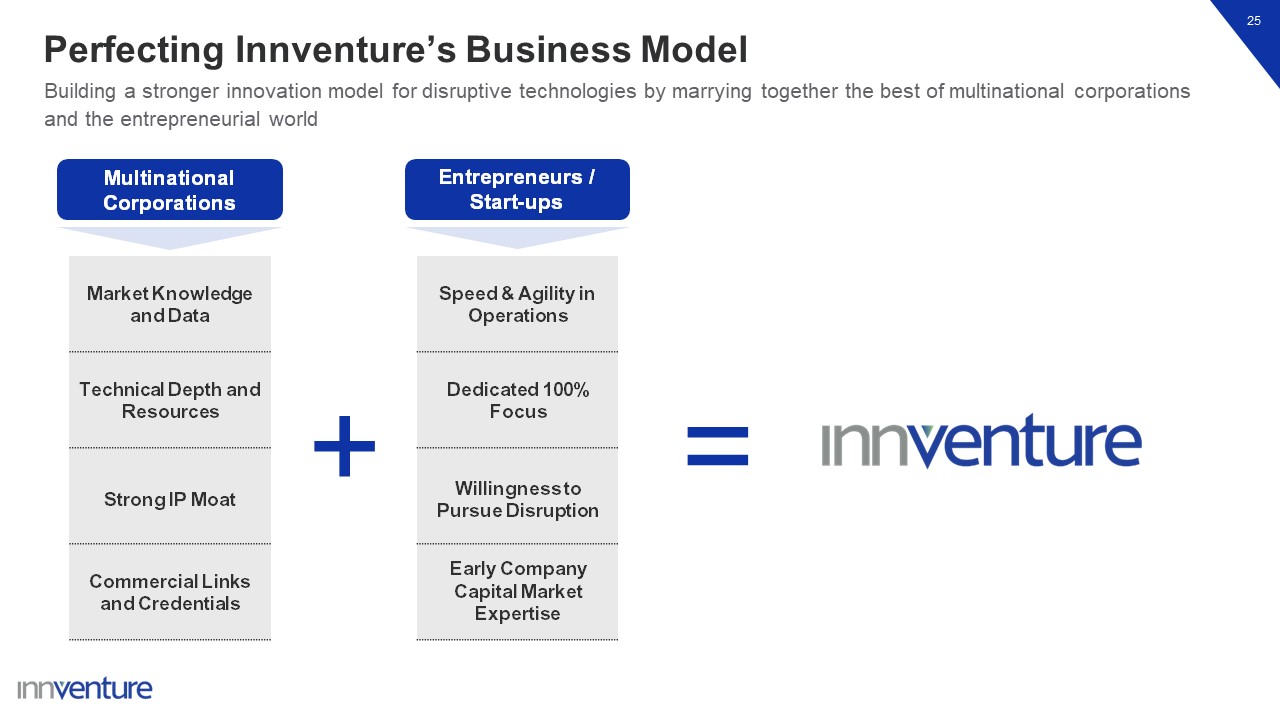

Market Knowledge and Data Technical Depth and Resources Strong IP

Moat Commercial Links and Credentials 25 Multinational Corporations Perfecting Innventure’s Business Model Building a stronger innovation model for disruptive technologies by marrying together the best of multinational corporations and the

entrepreneurial world Speed & Agility in Operations Dedicated 100% Focus Willingness to Pursue Disruption Early Company Capital Market Expertise Entrepreneurs / Start-ups + =

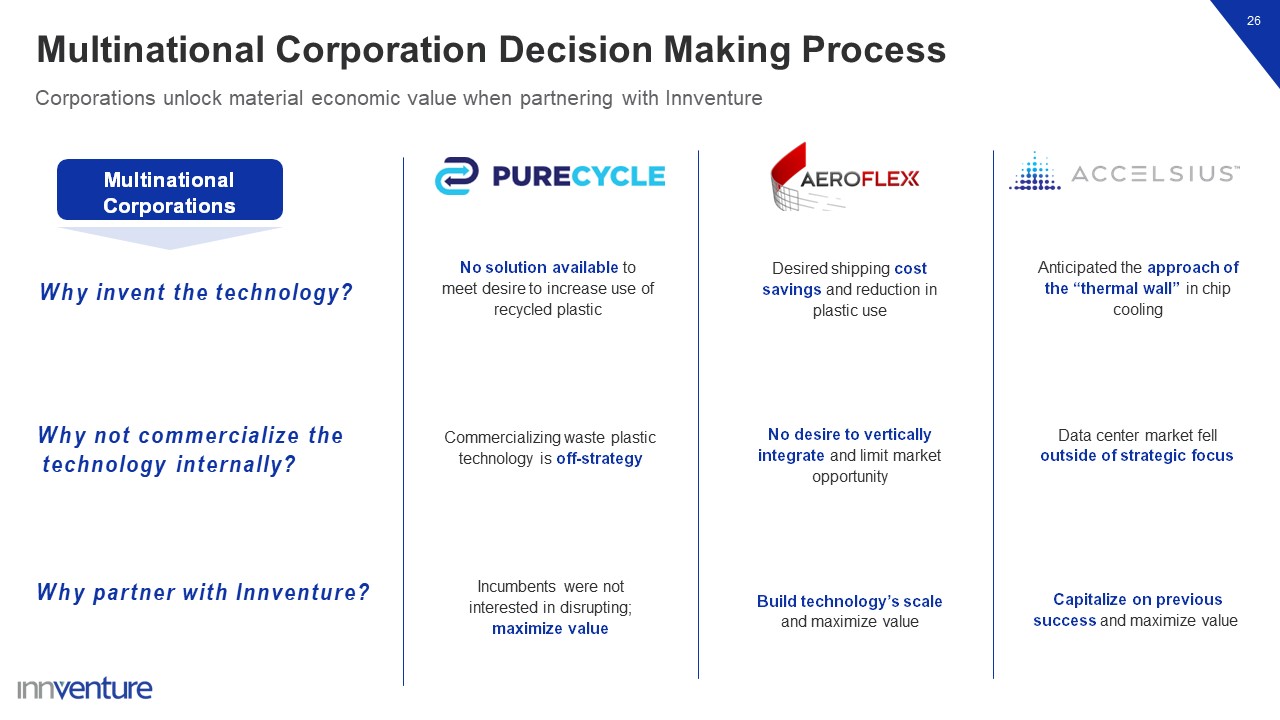

Multinational Corporation Decision Making Process 26 Why invent the

technology? Why not commercialize the technology internally? Why partner with Innventure? No solution available to meet desire to increase use of recycled plastic Commercializing waste plastic technology is off-strategy Incumbents were not

interested in disrupting; maximize value Desired shipping cost savings and reduction in plastic use No desire to vertically integrate and limit market opportunity Build technology’s scale and maximize value Anticipated the approach of the

“thermal wall” in chip cooling Data center market fell outside of strategic focus Capitalize on previous success and maximize value Corporations unlock material economic value when partnering with Innventure Multinational Corporations

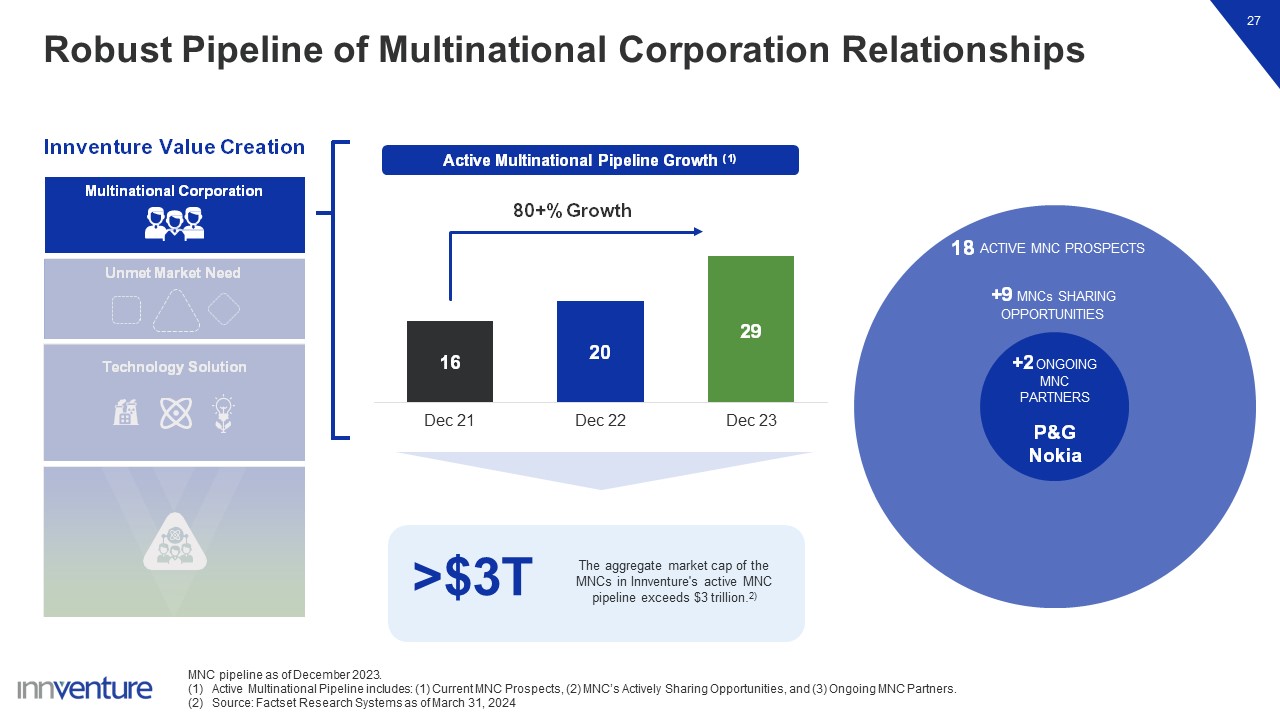

Robust Pipeline of Multinational Corporation Relationships 27 Active

Multinational Pipeline Growth (1) 16 20 29 Dec 21 Dec 22 Dec 23 80+% Growth MNC pipeline as of December 2023. Active Multinational Pipeline includes: (1) Current MNC Prospects, (2) MNC’s Actively Sharing Opportunities, and (3) Ongoing

MNC Partners. Source: Factset Research Systems as of March 31, 2024 Innventure Value Creation +2 ONGOING MNC PARTNERS P&G Nokia +9 MNCs SHARING OPPORTUNITIES 18 ACTIVE MNC PROSPECTS Technology Solution Strategic

Execution Innventure Company Unmet Market Need Multinational Corporation >$3T The aggregate market cap of the MNCs in Innventure's active MNC pipeline exceeds $3 trillion.2)

Colin Scott Head of DownSelect® DownSelect®

What is DownSelect®? Rigorous analysis to generate outsized risk-adjusted returns

through disruptive company formation

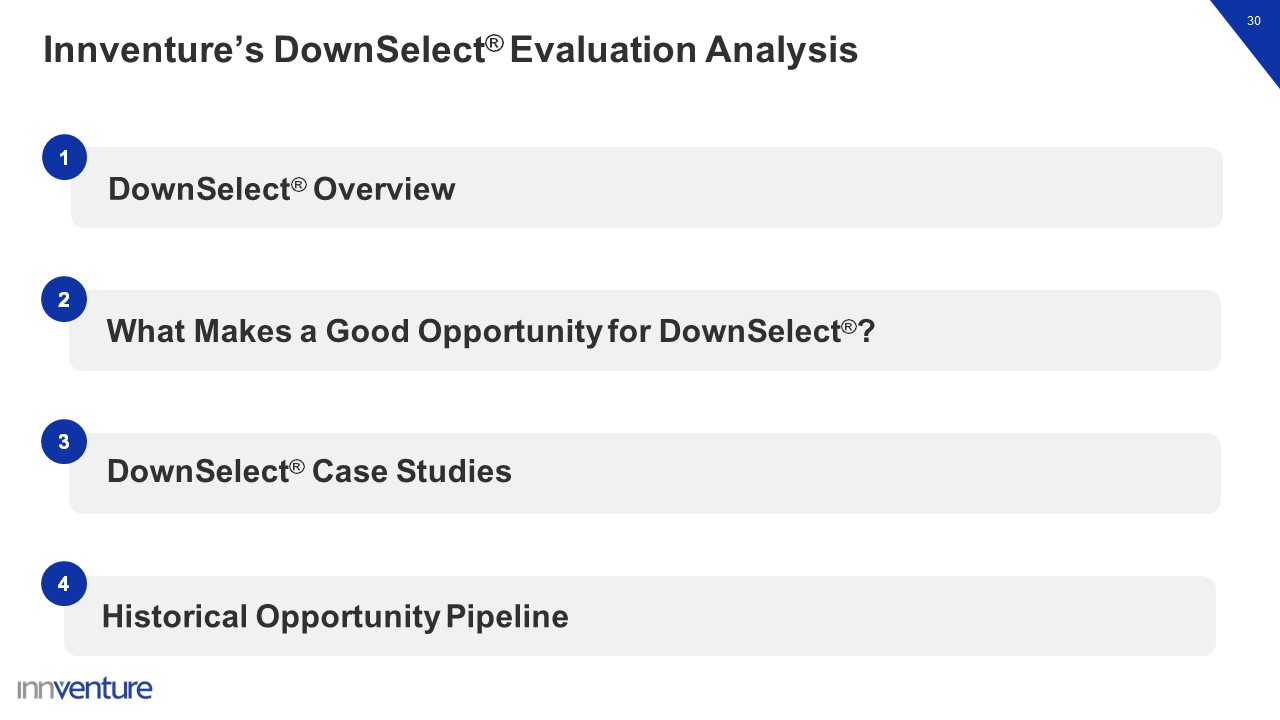

Innventure’s DownSelect® Evaluation Analysis 30 Historical Opportunity

Pipeline 3 DownSelect® Case Studies 2 What Makes a Good Opportunity for DownSelect®? 1 DownSelect® Overview 4

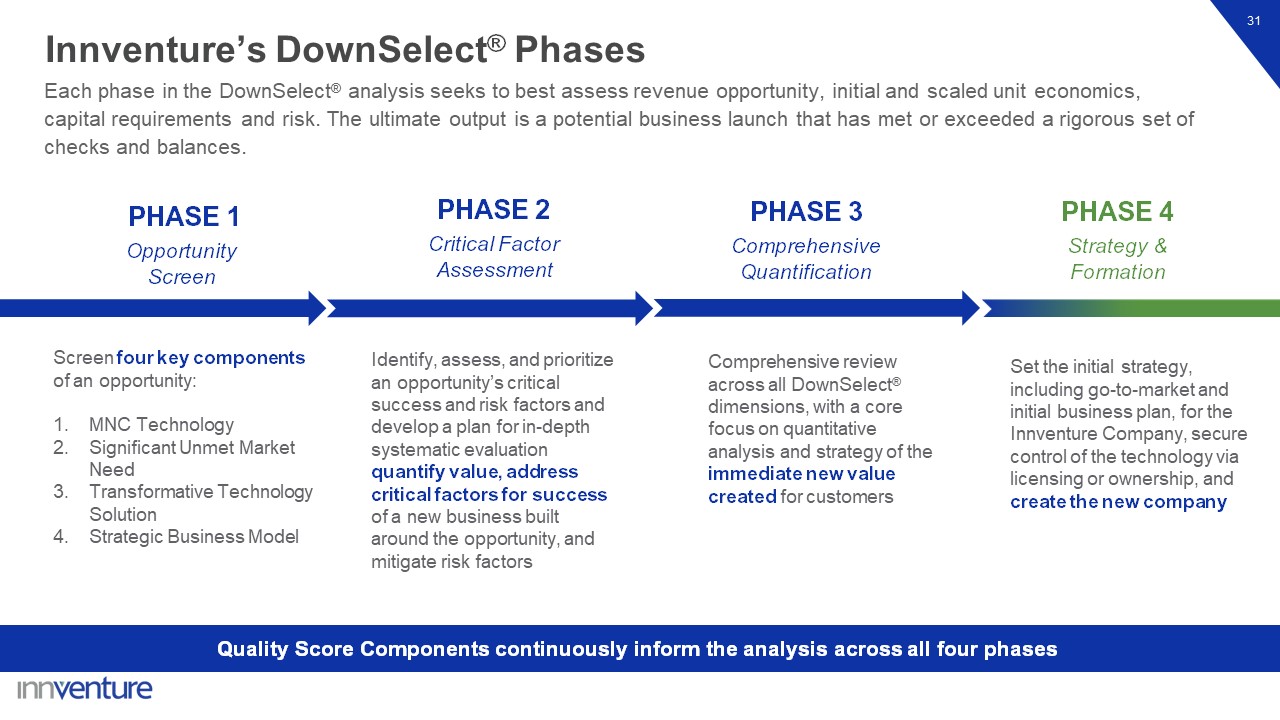

Innventure’s DownSelect® Phases Each phase in the DownSelect® analysis seeks to

best assess revenue opportunity, initial and scaled unit economics, capital requirements and risk. The ultimate output is a potential business launch that has met or exceeded a rigorous set of checks and balances. 31 PHASE 1 Opportunity

Screen PHASE 2 Critical Factor Assessment PHASE 4 Strategy & Formation PHASE 3 Comprehensive Quantification Quality Score Components continuously inform the analysis across all four phases Screen four key components of an

opportunity: MNC Technology Significant Unmet Market Need Transformative Technology Solution Strategic Business Model Identify, assess, and prioritize an opportunity’s critical success and risk factors and develop a plan for in-depth

systematic evaluation quantify value, address critical factors for success of a new business built around the opportunity, and mitigate risk factors Comprehensive review across all DownSelect® dimensions, with a core focus on quantitative

analysis and strategy of the immediate new value created for customers Set the initial strategy, including go-to-market and initial business plan, for the Innventure Company, secure control of the technology via licensing or ownership, and

create the new company

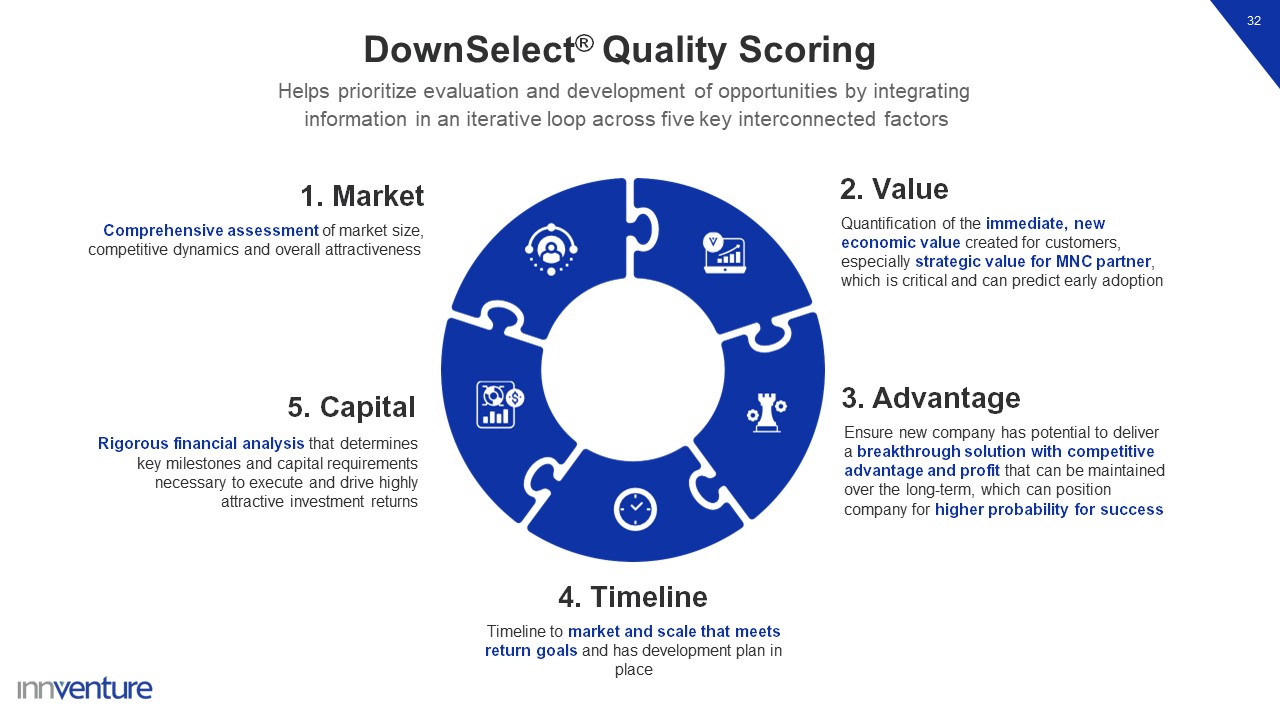

DownSelect® Quality Scoring Helps prioritize evaluation and development of

opportunities by integrating information in an iterative loop across five key interconnected factors 32 2. Value Quantification of the immediate, new economic value created for customers, especially strategic value for MNC partner, which is

critical and can predict early adoption 1. Market Comprehensive assessment of market size, competitive dynamics and overall attractiveness 3. Advantage Ensure new company has potential to deliver a breakthrough solution with competitive

advantage and profit that can be maintained over the long-term, which can position company for higher probability for success 4. Timeline Timeline to market and scale that meets return goals and has development plan in place 5.

Capital Rigorous financial analysis that determines key milestones and capital requirements necessary to execute and drive highly attractive investment returns

Drivers of a Strong Innventure Opportunity 33 Technology constantly changes

business across a diverse set of use-cases. Innventure has extensive experience screening technologies for commercialization to meet expected unmet market needs. Key market drivers and markets in need of a technology solution are what feed the

initial stage of DownSelect®. Innventure Value Creation Markets in Need of Technology Solutions Economic Value to Customers Drive Business & Profit Goals Consumer Retail, Packaging & Distribution Data Infrastructure &

Telecommunications Industrial Manufacturing & Operations Clean Energy Industrial Agriculture & Chemical Applications Healthcare & Life Science Services Market competition Supply chain insulation Sustainability &

regulatory compliance Risk Management Operating Margin Optimization of input, labor, energy, and distribution costs Improved scale and throughput Revenue capture in new categories and price points Meet current & evolving customer

needs Top Line Growth Technology Solution Strategic Execution Innventure Company Unmet Market Need Multinational Corporation

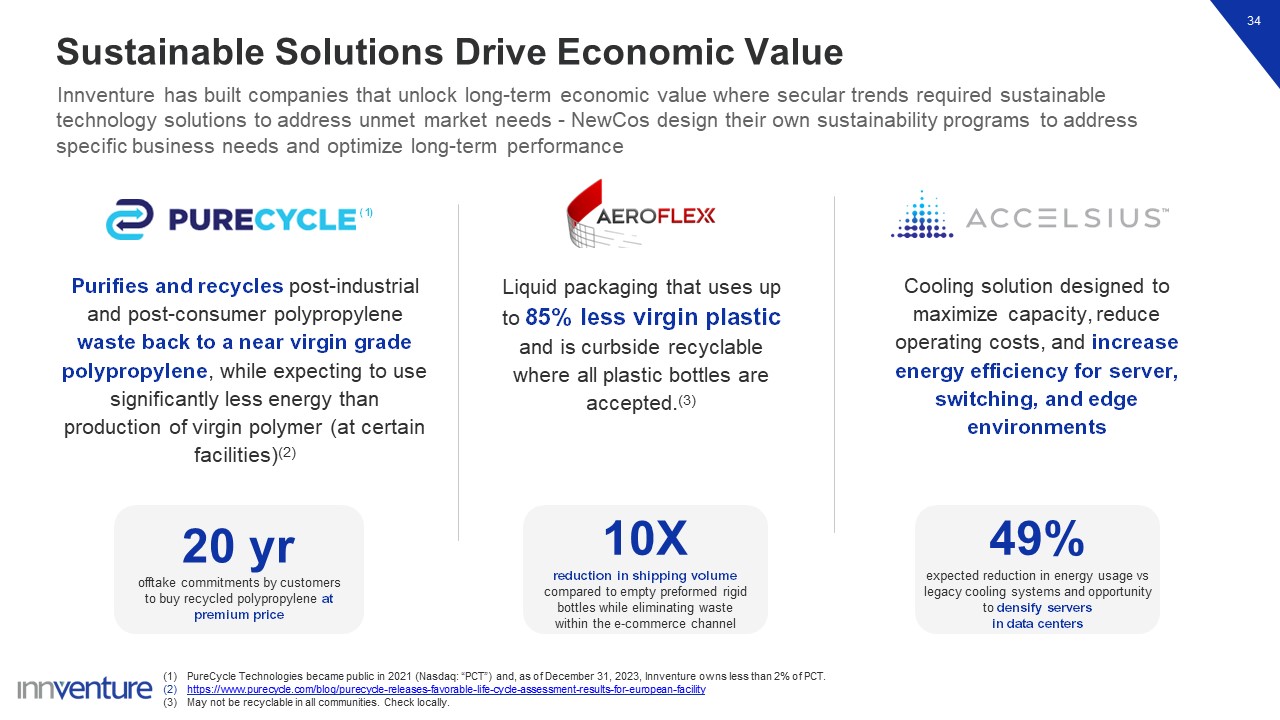

10X reduction in shipping volume compared to empty preformed rigid bottles while

eliminating waste within the e-commerce channel Sustainable Solutions Drive Economic Value Innventure has built companies that unlock long-term economic value where secular trends required sustainable technology solutions to address unmet

market needs - NewCos design their own sustainability programs to address specific business needs and optimize long-term performance 34 Purifies and recycles post-industrial and post-consumer polypropylene waste back to a near virgin grade

polypropylene, while expecting to use significantly less energy than production of virgin polymer (at certain facilities)(2) PureCycle Technologies became public in 2021 (Nasdaq: “PCT”) and, as of December 31, 2023, Innventure owns less than

2% of PCT. https://www.purecycle.com/blog/purecycle-releases-favorable-life-cycle-assessment-results-for-european-facility May not be recyclable in all communities. Check locally. Liquid packaging that uses up to 85% less virgin plastic and

is curbside recyclable where all plastic bottles are accepted.(3) Cooling solution designed to maximize capacity, reduce operating costs, and increase energy efficiency for server, switching, and edge environments (1) 49% expected reduction

in energy usage vs legacy cooling systems and opportunity to densify servers in data centers 20 yr offtake commitments by customers to buy recycled polypropylene at premium price

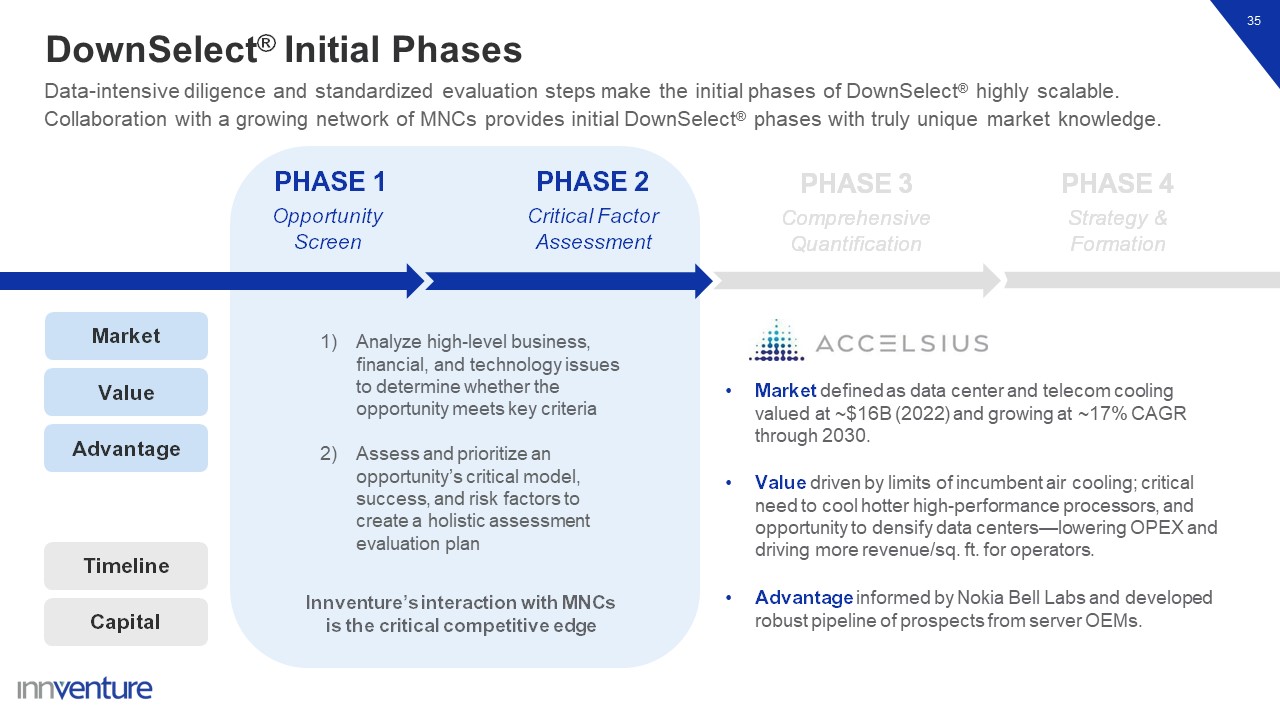

DownSelect® Initial Phases Data-intensive diligence and standardized evaluation

steps make the initial phases of DownSelect® highly scalable. Collaboration with a growing network of MNCs provides initial DownSelect® phases with truly unique market knowledge. 35 PHASE 1 Opportunity Screen PHASE 2 Critical Factor

Assessment PHASE 4 Strategy & Formation PHASE 3 Comprehensive Quantification 1) Analyze high-level business, financial, and technology issues to determine whether the opportunity meets key criteria 2) Assess and prioritize an

opportunity’s critical model, success, and risk factors to create a holistic assessment evaluation plan Market defined as data center and telecom cooling valued at ~$16B (2022) and growing at ~17% CAGR through 2030. Value driven by limits of

incumbent air cooling; critical need to cool hotter high-performance processors, and opportunity to densify data centers—lowering OPEX and driving more revenue/sq. ft. for operators. Advantage informed by Nokia Bell Labs and developed robust

pipeline of prospects from server OEMs. Innventure’s interaction with MNCs is the critical competitive edge Capital Timeline Market Value Advantage

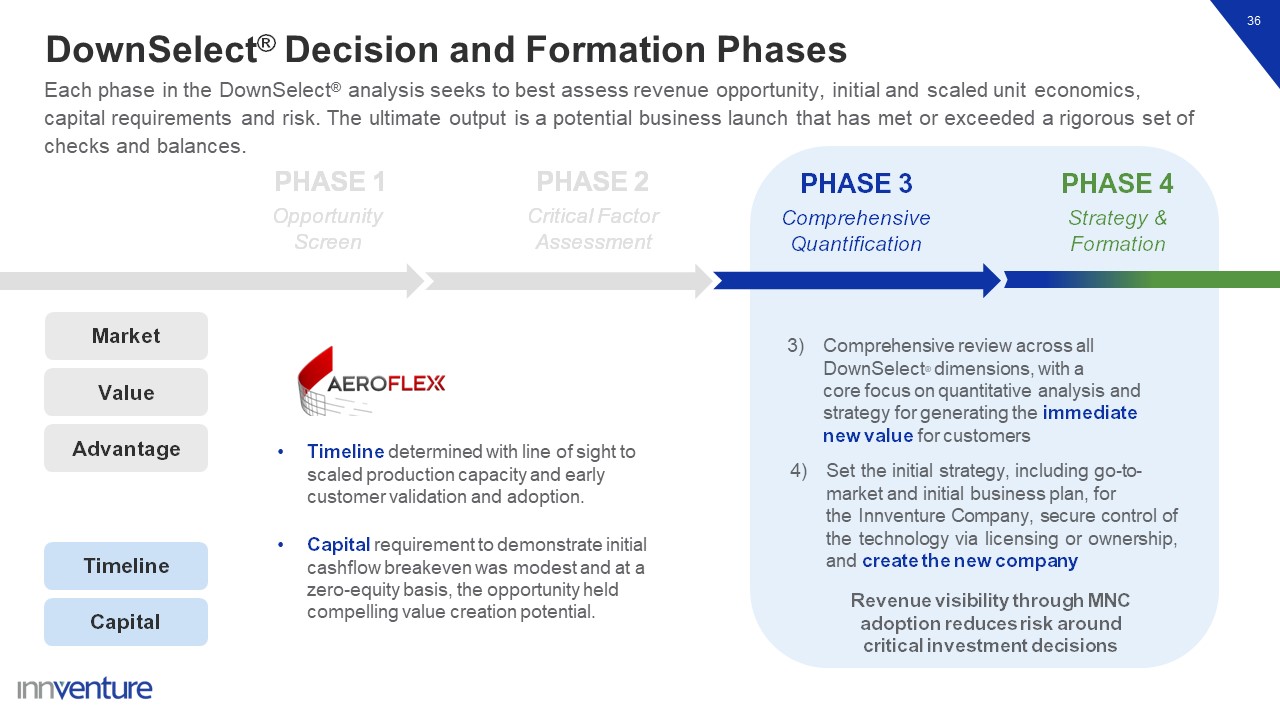

DownSelect® Decision and Formation Phases 36 Each phase in the DownSelect®

analysis seeks to best assess revenue opportunity, initial and scaled unit economics, capital requirements and risk. The ultimate output is a potential business launch that has met or exceeded a rigorous set of checks and balances. PHASE

1 Opportunity Screen PHASE 2 Critical Factor Assessment PHASE 4 Strategy & Formation PHASE 3 Comprehensive Quantification Comprehensive review across all DownSelect® dimensions, with a core focus on quantitative analysis and

strategy for generating the immediate new value for customers Set the initial strategy, including go-to- market and initial business plan, for the Innventure Company, secure control of the technology via licensing or ownership, and create the

new company Timeline determined with line of sight to scaled production capacity and early customer validation and adoption. Capital requirement to demonstrate initial cashflow breakeven was modest and at a zero-equity basis, the opportunity

held compelling value creation potential. Revenue visibility through MNC adoption reduces risk around critical investment decisions Capital Timeline Market Value Advantage

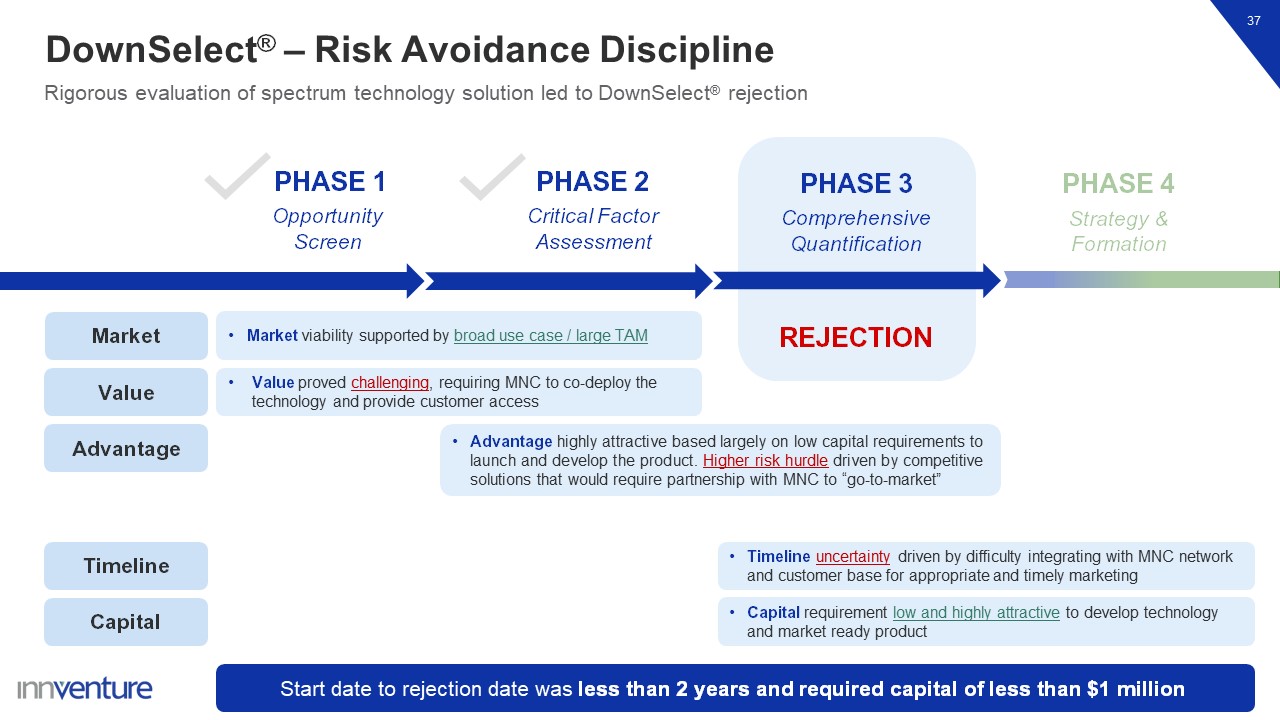

Capital Timeline DownSelect® – Risk Avoidance Discipline 37 Rigorous

evaluation of spectrum technology solution led to DownSelect® rejection PHASE 1 Opportunity Screen PHASE 2 Critical Factor Assessment PHASE 4 Strategy & Formation PHASE 3 Comprehensive Quantification Market REJECTION Start date

to rejection date was less than 2 years and required capital of less than $1 million Market viability supported by broad use case / large TAM Value proved challenging, requiring MNC to co-deploy the technology and provide customer

access Advantage highly attractive based largely on low capital requirements to launch and develop the product. Higher risk hurdle driven by competitive solutions that would require partnership with MNC to

“go-to-market” Value Advantage Timeline uncertainty driven by difficulty integrating with MNC network and customer base for appropriate and timely marketing Capital requirement low and highly attractive to develop technology and market

ready product

The Innventure Strike Zone 38 Innventure’s data-centric approach reduces

principal risk to scaling and execution (1) Such technology has been demonstrated as a proof of concept but has not yet been scaled or commercialized. Commercial-grade technology solutions that enable significant, additional quantifiable

value opportunities Seeking to build businesses leveraging technology solutions that have been significantly de- risked by MNC partners with benefit of market data Leverage MNC data and built-in adoption to confirm market demand and identify

early customers, mitigating risk for go-to-market pathway and ensuring customer adoption Targeting opportunities believed to have the potential for billion+ dollar outcomes Path to Economic Return De-Risked Business 1 Unmet Customer

Need 2 Proven Industrial Technology(1) 3 4

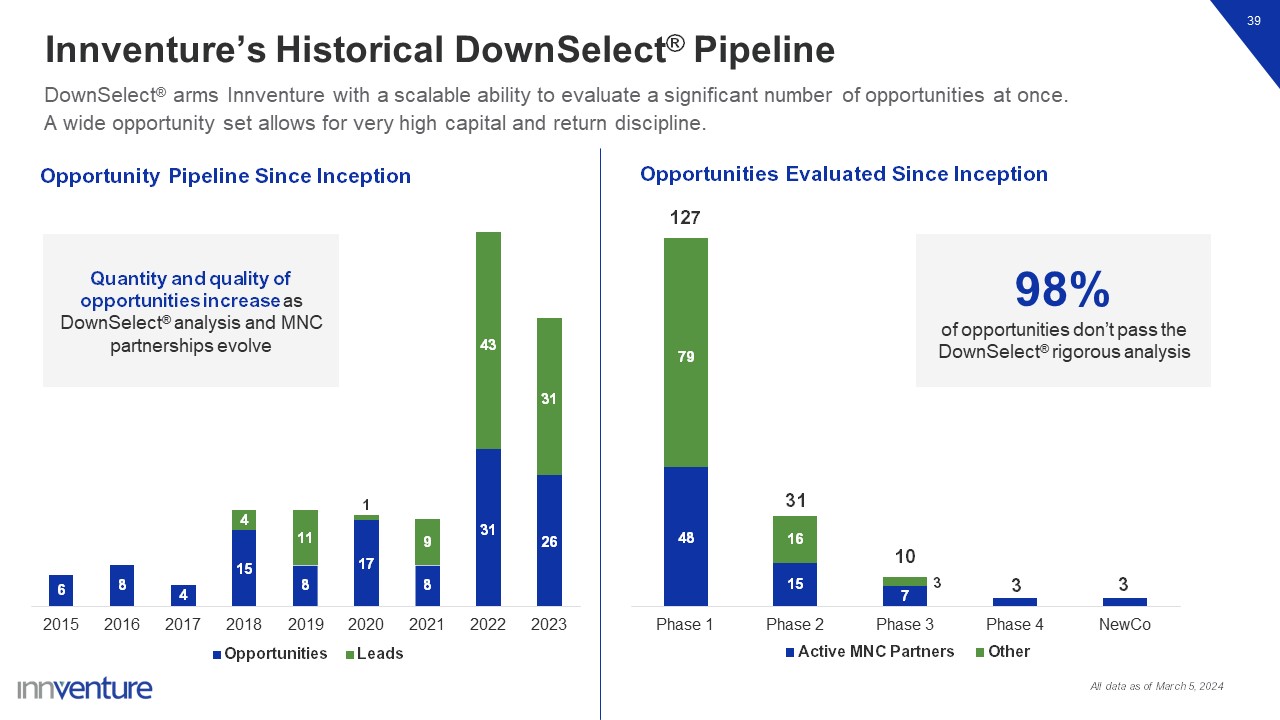

48 15 7 3 3 79 16 3 Phase 1 NewCo Opportunities Evaluated Since

Inception Phase 2 Phase 3 Active MNC Partners Phase 4 Other 98% of opportunities don’t pass the DownSelect® rigorous analysis Innventure’s Historical DownSelect® Pipeline 39 DownSelect® arms Innventure with a scalable ability to

evaluate a significant number of opportunities at once. A wide opportunity set allows for very high capital and return discipline. 6 8 4 15 8 17 8 31 26 4 11 1 9 43 31 Opportunity Pipeline Since Inception 2015 2016 2017 2018

2019 Opportunities 2020 2021 2022 2023 Leads 127 31 10 Quantity and quality of opportunities increase as DownSelect® analysis and MNC partnerships evolve All data as of March 5, 2024

Break

AeroFlexx Investor Presentation | Private and Confidential 41 Revolutionizing

Liquid Packaging

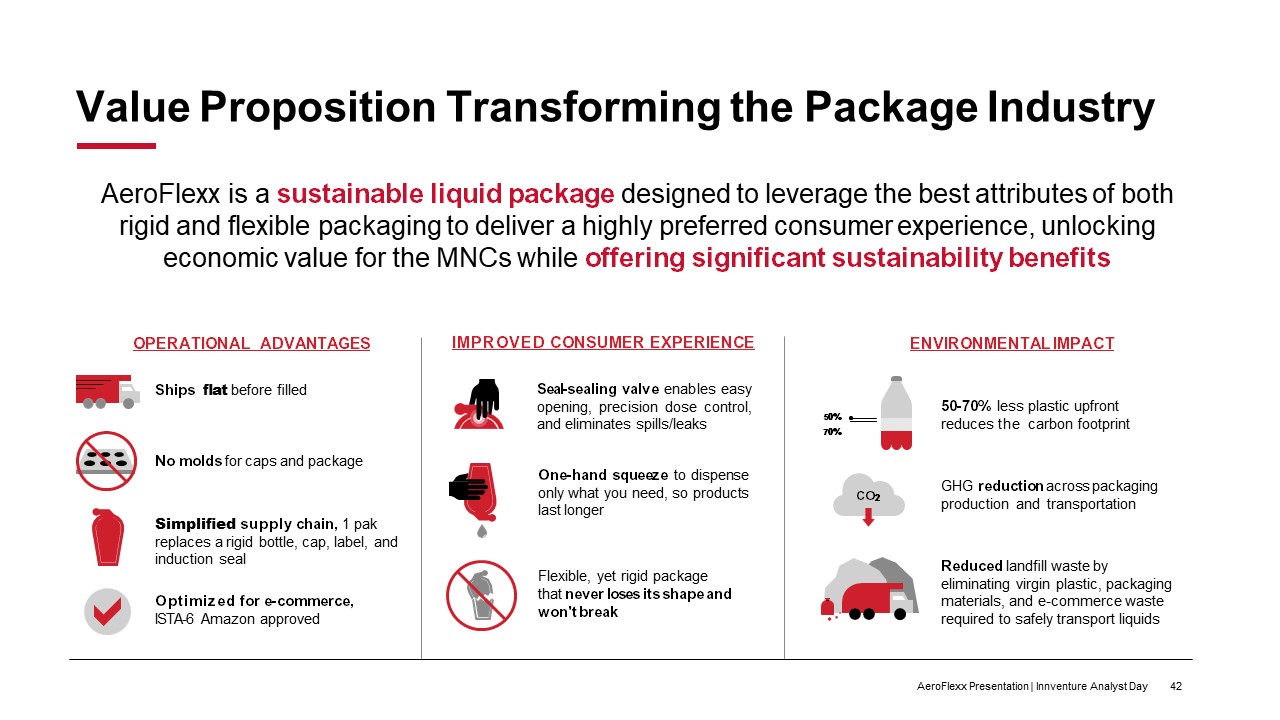

AeroFlexx is a sustainable liquid package designed to leverage the best attributes

of both rigid and flexible packaging to deliver a highly preferred consumer experience, unlocking economic value for the MNCs while offering significant sustainability benefits Value Proposition Transforming the Package Industry AeroFlexx

Presentation | Innventure Analyst Day 42 GHG reduction across packaging production and transportation Reduced landfill waste by eliminating virgin plastic, packaging materials, and e-commerce waste required to safely transport

liquids IMPROVED CONSUMER EXPERIENCE One-hand squeeze to dispense only what you need, so products last longer Flexible, yet rigid package that never loses its shape and won't break OPERATIONAL ADVANTAGES Ships flat before filled No molds

for caps and package Simplified supply chain, 1 pak replaces a rigid bottle, cap, label, and induction seal Optimized for e-commerce, ISTA-6 Amazon approved 50-70% less plastic upfront reduces the carbon footprint ENVIRONMENTAL IMPACT 50%

70% CO2 Seal-sealing valve enables easy opening, precision dose control, and eliminates spills/leaks

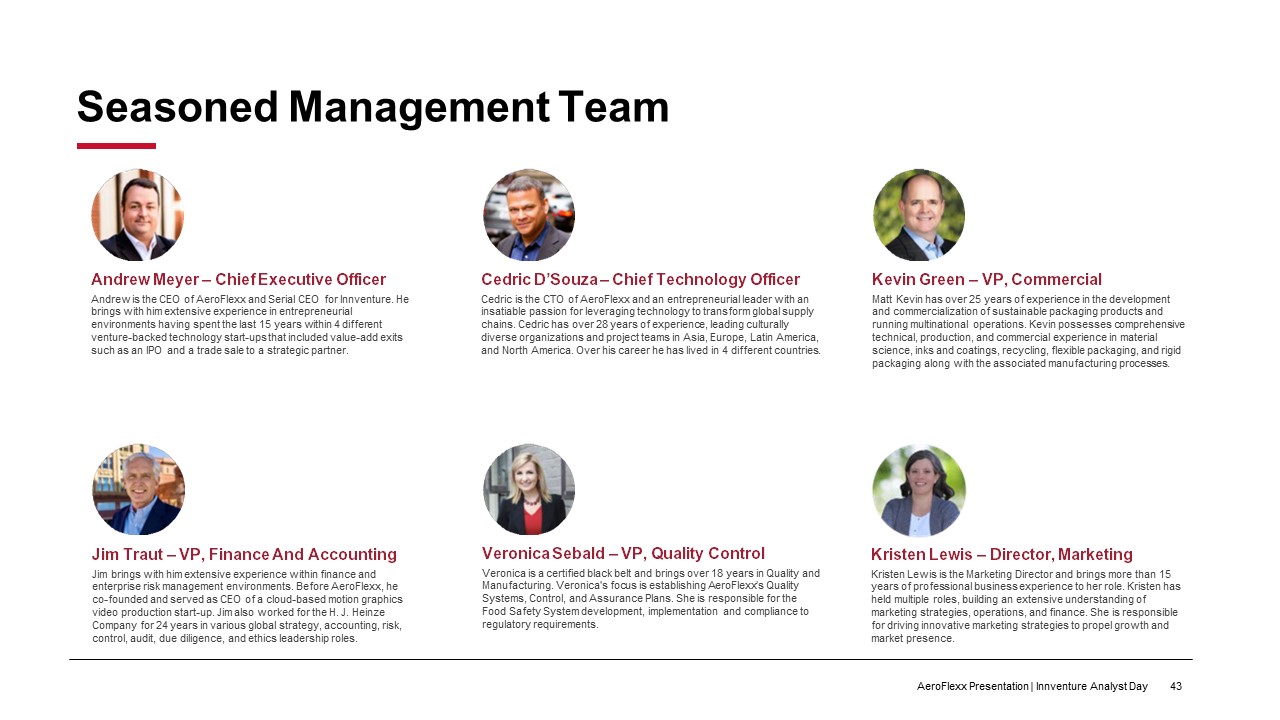

Seasoned Management Team Andrew Meyer – Chief Executive Officer Andrew is the

CEO of AeroFlexx and Serial CEO for Innventure. He brings with him extensive experience in entrepreneurial environments having spent the last 15 years within 4 different venture-backed technology start-ups that included value-add exits such as

an IPO and a trade sale to a strategic partner. Kevin Green – VP, Commercial Matt Kevin has over 25 years of experience in the development and commercialization of sustainable packaging products and running multinational operations. Kevin

possesses comprehensive technical, production, and commercial experience in material science, inks and coatings, recycling, flexible packaging, and rigid packaging along with the associated manufacturing processes. Jim Traut – VP, Finance And

Accounting Jim brings with him extensive experience within finance and enterprise risk management environments. Before AeroFlexx, he co-founded and served as CEO of a cloud-based motion graphics video production start-up. Jim also worked for

the H. J. Heinze Company for 24 years in various global strategy, accounting, risk, control, audit, due diligence, and ethics leadership roles. Cedric D’Souza – Chief Technology Officer Cedric is the CTO of AeroFlexx and an entrepreneurial

leader with an insatiable passion for leveraging technology to transform global supply chains. Cedric has over 28 years of experience, leading culturally diverse organizations and project teams in Asia, Europe, Latin America, and North America.

Over his career he has lived in 4 different countries. Veronica Sebald – VP, Quality Control Veronica is a certified black belt and brings over 18 years in Quality and Manufacturing. Veronica's focus is establishing AeroFlexx’s Quality

Systems, Control, and Assurance Plans. She is responsible for the Food Safety System development, implementation and compliance to regulatory requirements. Kristen Lewis – Director, Marketing Kristen Lewis is the Marketing Director and brings

more than 15 years of professional business experience to her role. Kristen has held multiple roles, building an extensive understanding of marketing strategies, operations, and finance. She is responsible for driving innovative marketing

strategies to propel growth and market presence. AeroFlexx Presentation | Innventure Analyst Day 43

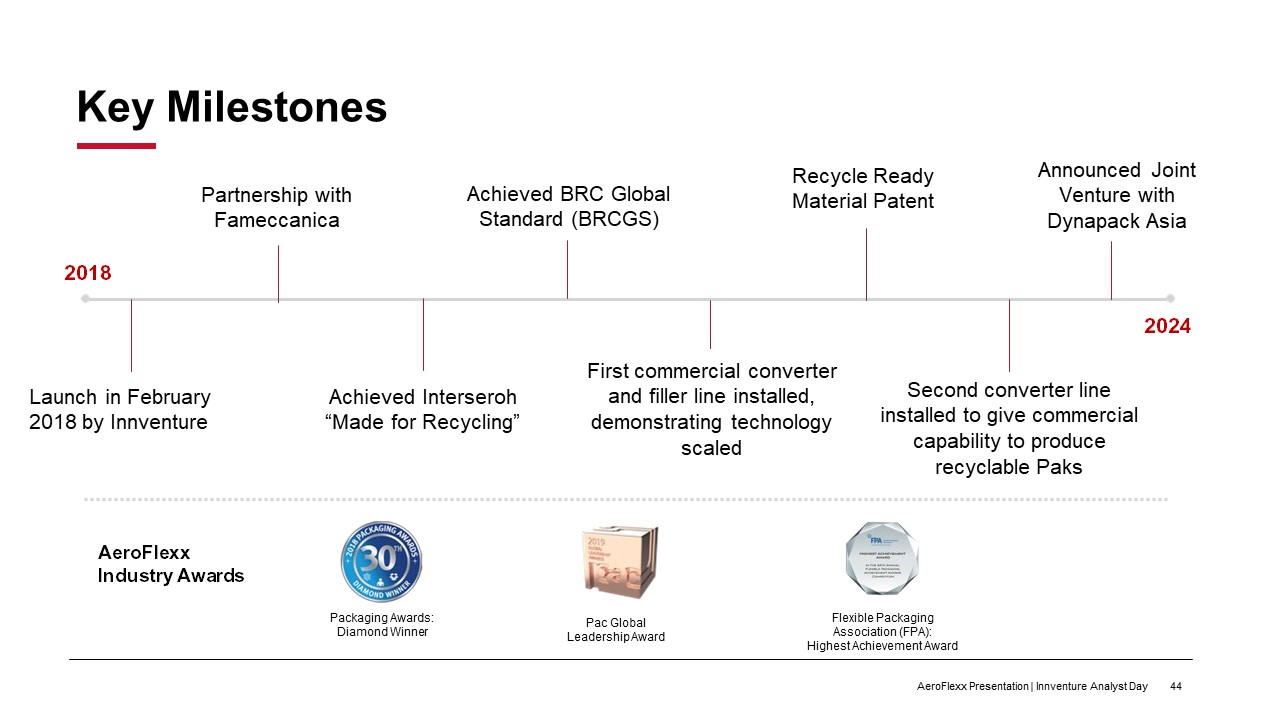

Key Milestones Launch in February 2018 by Innventure Announced Joint Venture

with Dynapack Asia Achieved BRC Global Standard (BRCGS) 2018 2024 Achieved Interseroh “Made for Recycling” Pac Global Leadership Award Second converter line installed to give commercial capability to produce recyclable Paks Recycle Ready

Material Patent First commercial converter and filler line installed, demonstrating technology scaled Packaging Awards: Diamond Winner Flexible Packaging Association (FPA): Highest Achievement Award Partnership with Fameccanica AeroFlexx

Industry Awards AeroFlexx Presentation | Innventure Analyst Day 44

Personal Care Household Products Pet Care Food Industrial AeroFlexx

technology has an estimated $400 billion addressable market across several market categories: AeroFlexx Presentation | Innventure Analyst Day 45 Substantial Addressable Market

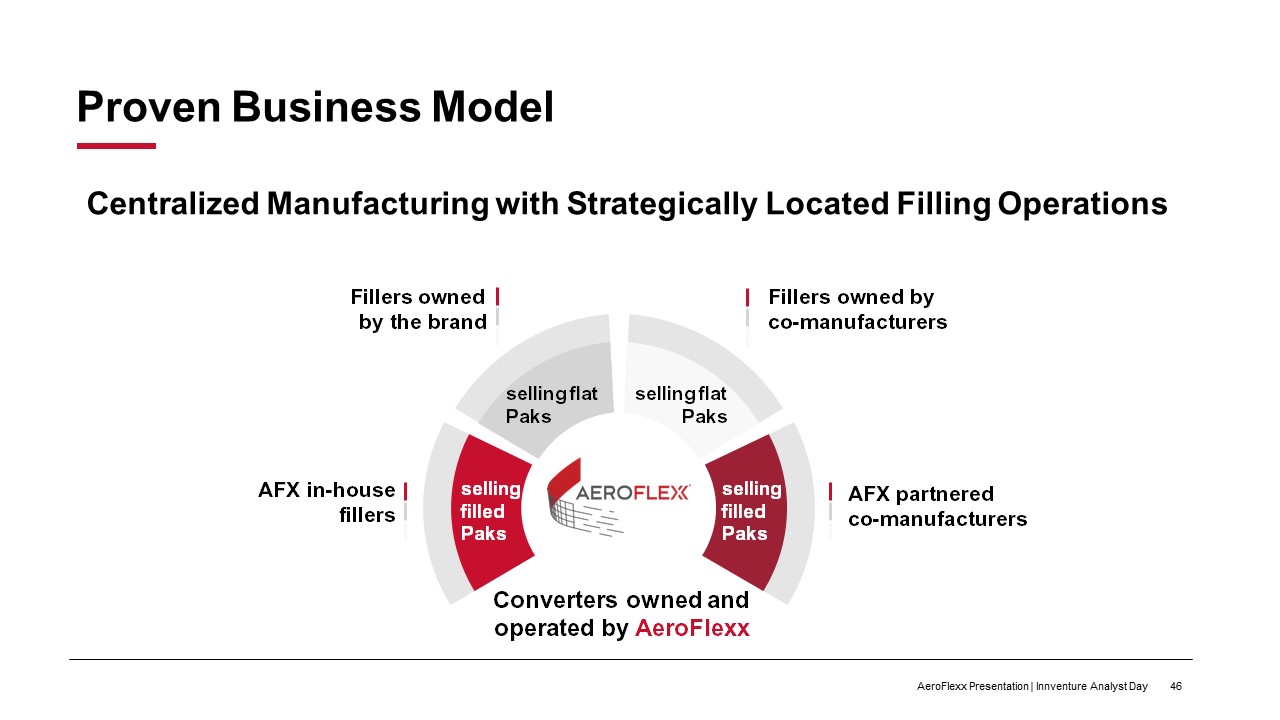

Proven Business Model Fillers owned by co-manufacturers Fillers owned by the

brand AFX in-house fillers AFX partnered co-manufacturers Converters owned and operated by AeroFlexx selling filled Paks selling filled Paks selling flat Paks selling flat Paks AeroFlexx Presentation | Innventure Analyst

Day 46 Centralized Manufacturing with Strategically Located Filling Operations

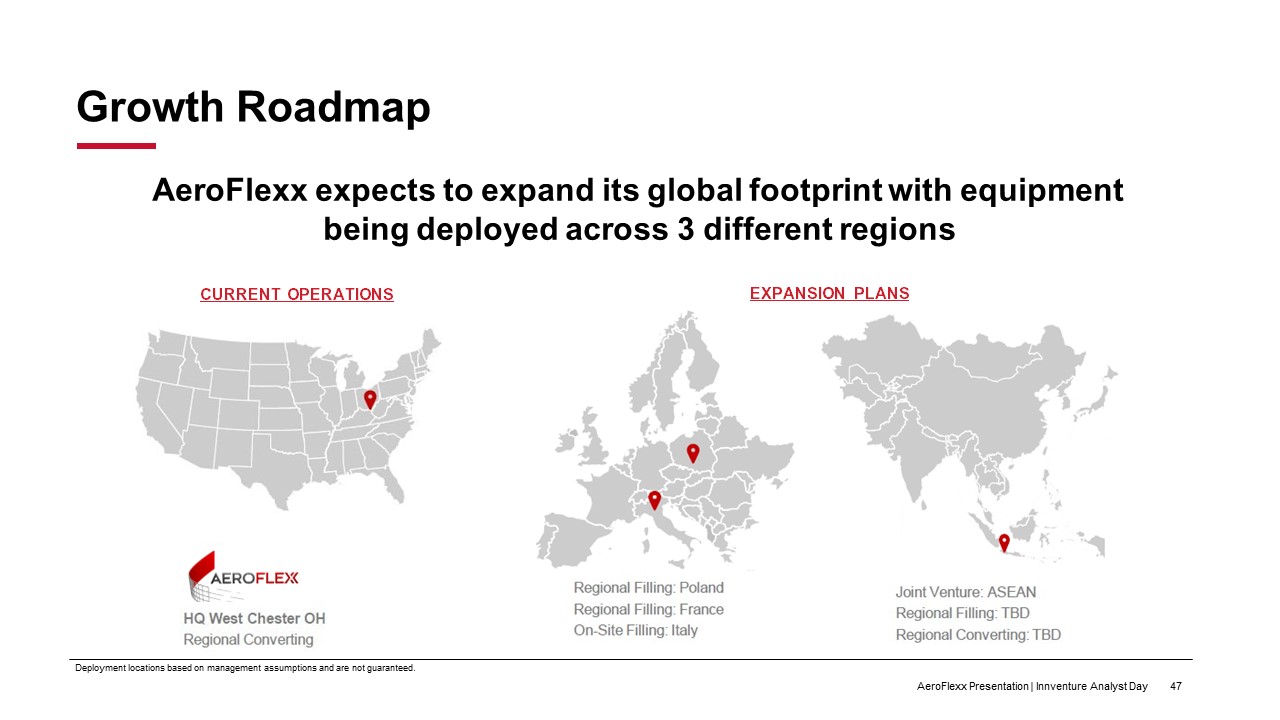

Growth Roadmap AeroFlexx expects to expand its global footprint with equipment

being deployed across 3 different regions Deployment locations based on management assumptions and are not guaranteed. AeroFlexx Presentation | Innventure Analyst Day 47 CURRENT OPERATIONS EXPANSION PLANS

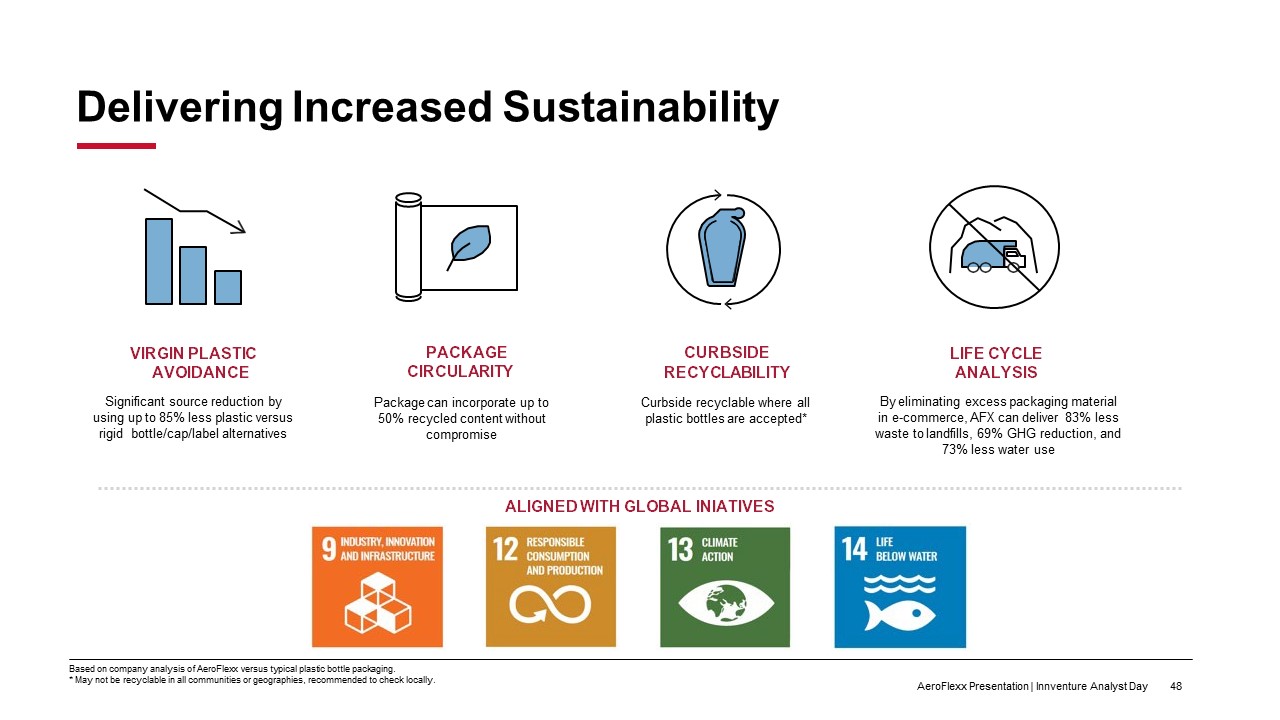

Delivering Increased Sustainability VIRGIN PLASTIC AVOIDANCE Significant source

reduction by using up to 85% less plastic versus rigid bottle/cap/label alternatives CURBSIDE RECYCLABILITY Curbside recyclable where all plastic bottles are accepted* PACKAGE CIRCULARITY Package can incorporate up to 50% recycled content

without compromise LIFE CYCLE ANALYSIS By eliminating excess packaging material in e-commerce, AFX can deliver 83% less waste to landfills, 69% GHG reduction, and 73% less water use ALIGNED WITH GLOBAL INIATIVES Based on company analysis of

AeroFlexx versus typical plastic bottle packaging. * May not be recyclable in all communities or geographies, recommended to check locally. AeroFlexx Presentation | Innventure Analyst Day 48

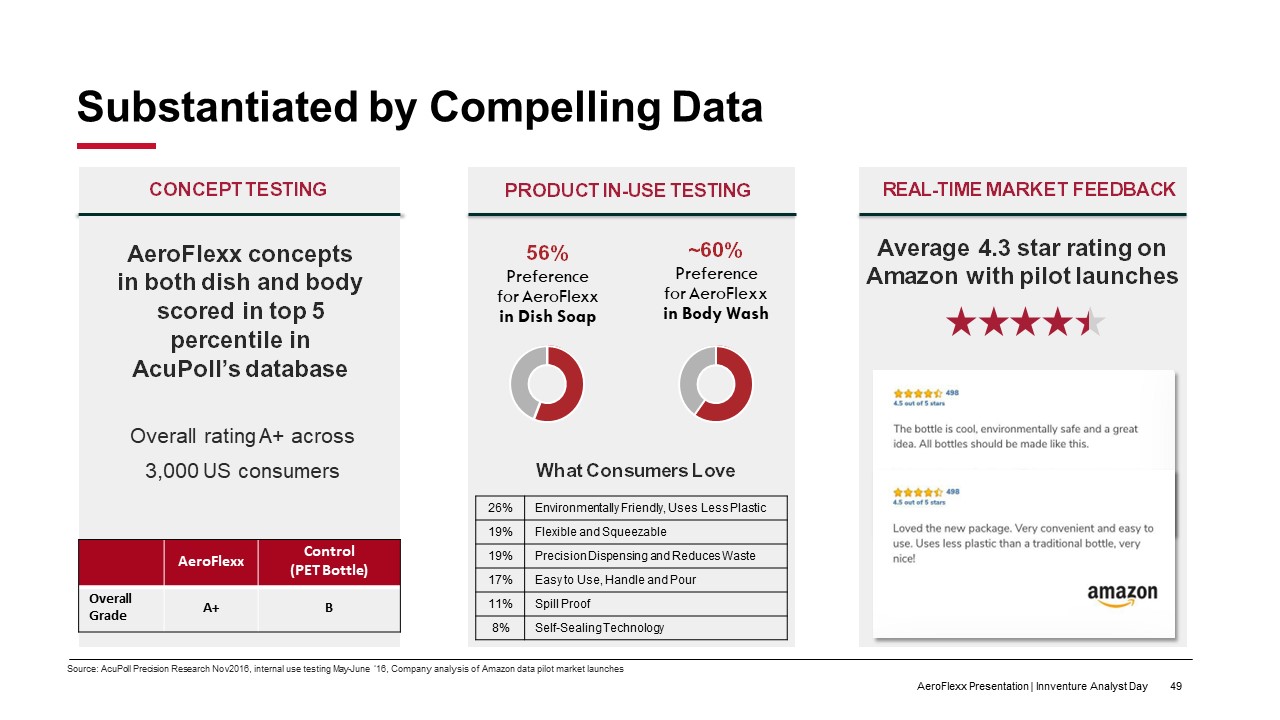

Substantiated by Compelling Data Source: AcuPoll Precision Research Nov2016,

internal use testing May-June ‘16, Company analysis of Amazon data pilot market launches AeroFlexx Presentation | Innventure Analyst Day 49 CONCEPT TESTING AeroFlexx concepts in both dish and body scored in top 5 percentile in AcuPoll’s

database Overall rating A+ across 3,000 US consumers AeroFlexx Control (PET Bottle) Overall Grade A+ B 56% Preference for AeroFlexx in Dish Soap ~60% Preference for AeroFlexx in Body Wash What Consumers Love 26% Environmentally

Friendly, Uses Less Plastic 19% Flexible and Squeezable 19% Precision Dispensing and Reduces Waste 17% Easy to Use, Handle and Pour 11% Spill Proof 8% Self-Sealing Technology Average 4.3 star rating on Amazon with pilot

launches REAL-TIME MARKET FEEDBACK PRODUCT IN-USE TESTING

Unlocking Significant Brand Value AeroFlexx Presentation | Innventure Analyst

Day 50 REDUCES SOURCING COMPLEXITY AND TRANSPORTATION COST LOWERS WAREHOUSE AND INVENTORY COST REQUIREMENTS ISTA-6 AMAZON APPROVED OMNI-CHANNEL READY OFF THE FILLING LINE NEW SIZE AND SHAPE DEVELOPMENT EFFICIENCY TAMPER-PROOF FOR PRODUCT

SAFETY AeroFlexx is breaking the paradigm with a sustainable package that consumers love and adds real value to MNCs’ bottom line

Josh Claman Chief Executive Officer Accelsius We Bring the Cool

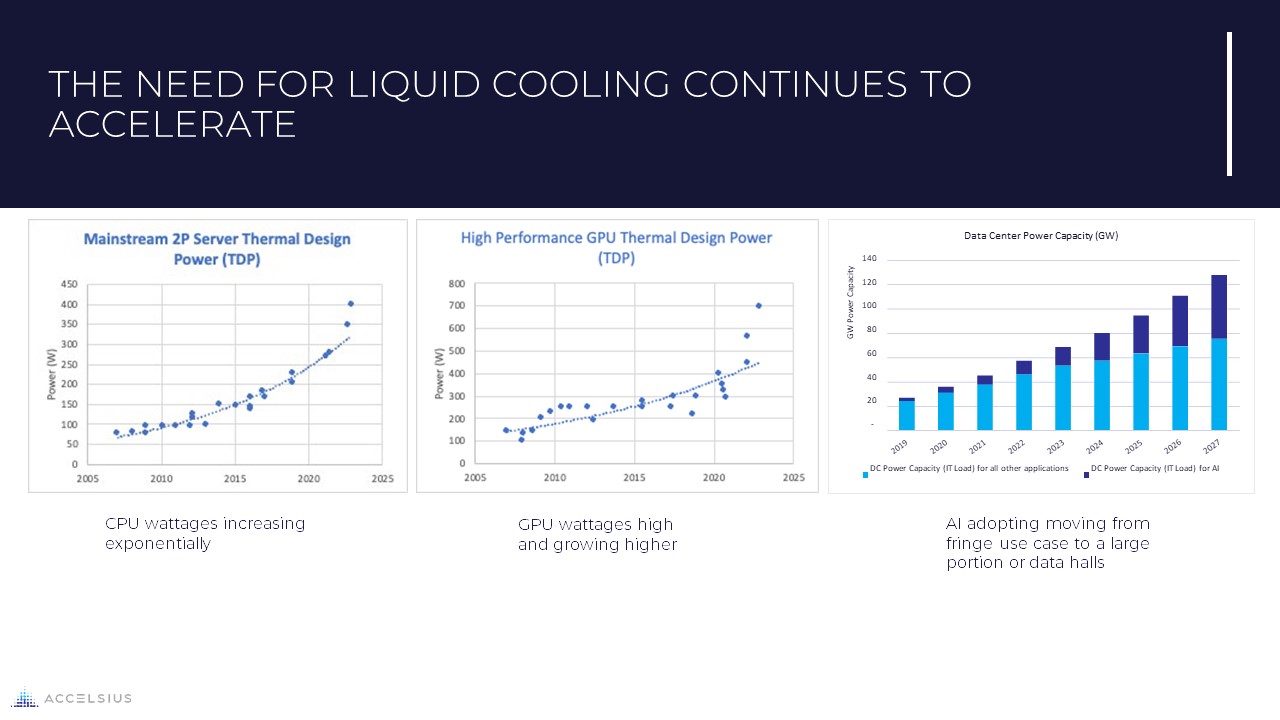

THE NEED FOR LIQUID COOLING CONTINUES TO ACCELERATE CPU wattages increasing

exponentially GPU wattages high and growing higher AI adopting moving from fringe use case to a large portion or data halls GW Power Capacity Data Center Power Capacity (GW) 140 120 100 80 60 40 20 - DC Power Capacity (IT Load) for

all other applications DC Power Capacity (IT Load) for AI

HYPE AND CONCERN – BOTH TAILWINDS FOR ACCELSIUS

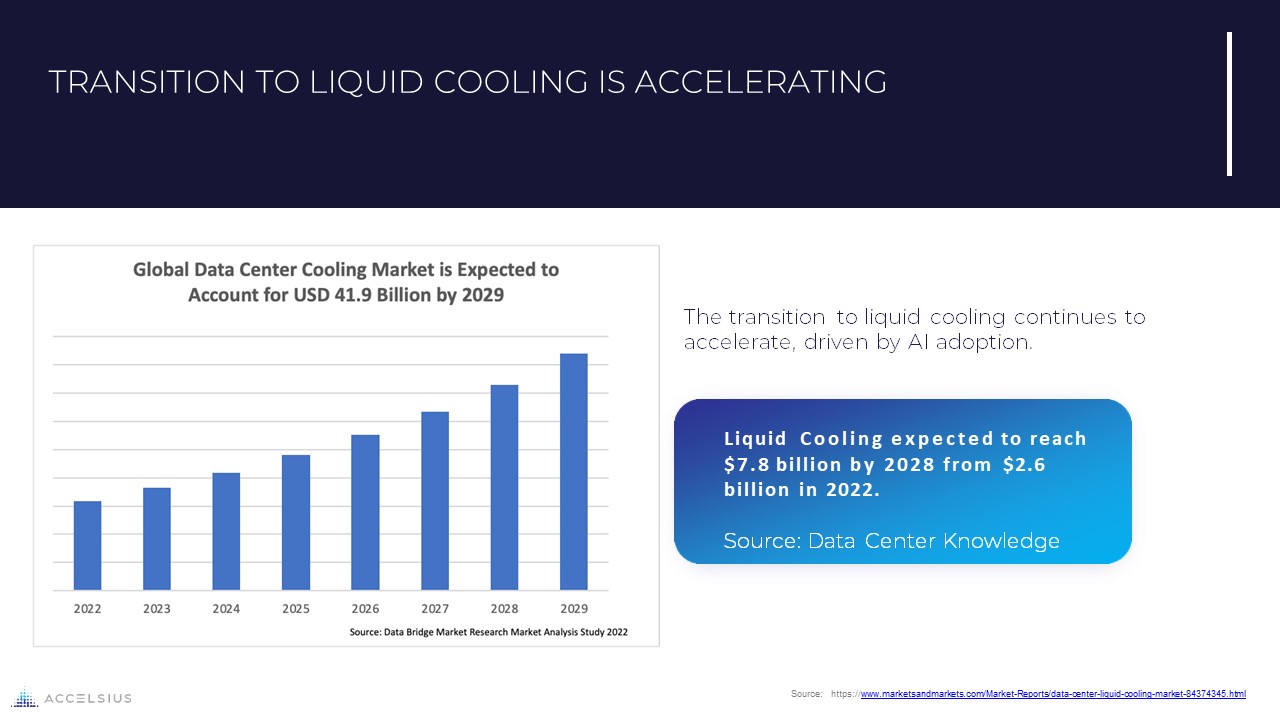

TRANSITION TO LIQUID COOLING IS ACCELERATING Liquid Cooling expected to

reach $7.8 billion by 2028 from $2.6 billion in 2022. Source: Data Center Knowledge The transition to liquid cooling continues to accelerate, driven by AI adoption. Source:

https://www.marketsandmarkets.com/Market-Reports/data-center-liquid-cooling-market-84374345.html

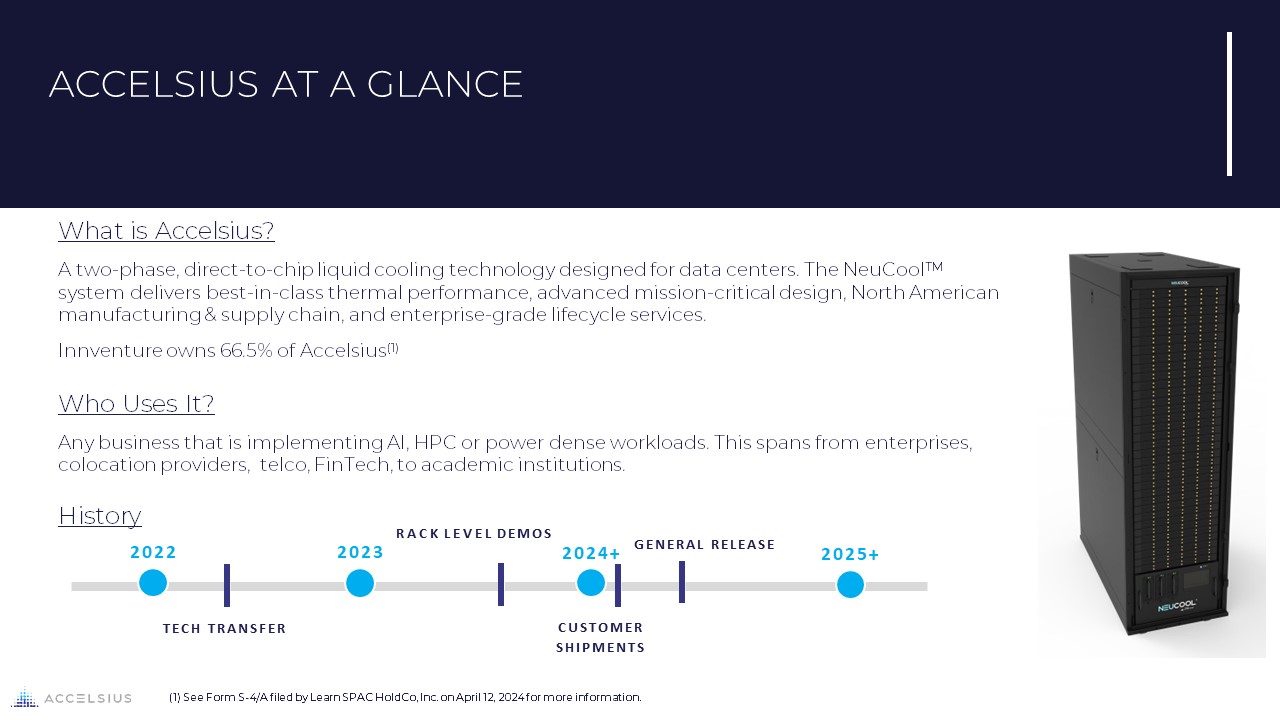

ACCELSIUS AT A GLANCE What is Accelsius? A two-phase, direct-to-chip liquid

cooling technology designed for data centers. The NeuCoolTM system delivers best-in-class thermal performance, advanced mission-critical design, North American manufacturing & supply chain, and enterprise-grade lifecycle

services. Innventure owns 66.5% of Accelsius(1) Who Uses It? Any business that is implementing AI, HPC or power dense workloads. This spans from enterprises, colocation providers, telco, FinTech, to academic

institutions. History 2022 2023 RACK LEVEL DEMOS 2024+ TECH TRANSFER CUSTOMER SHIPMENTS GENERAL RELEASE (1) See Form S-4/A filed by Learn SPAC HoldCo, Inc. on April 12, 2024 for more information. 2025+

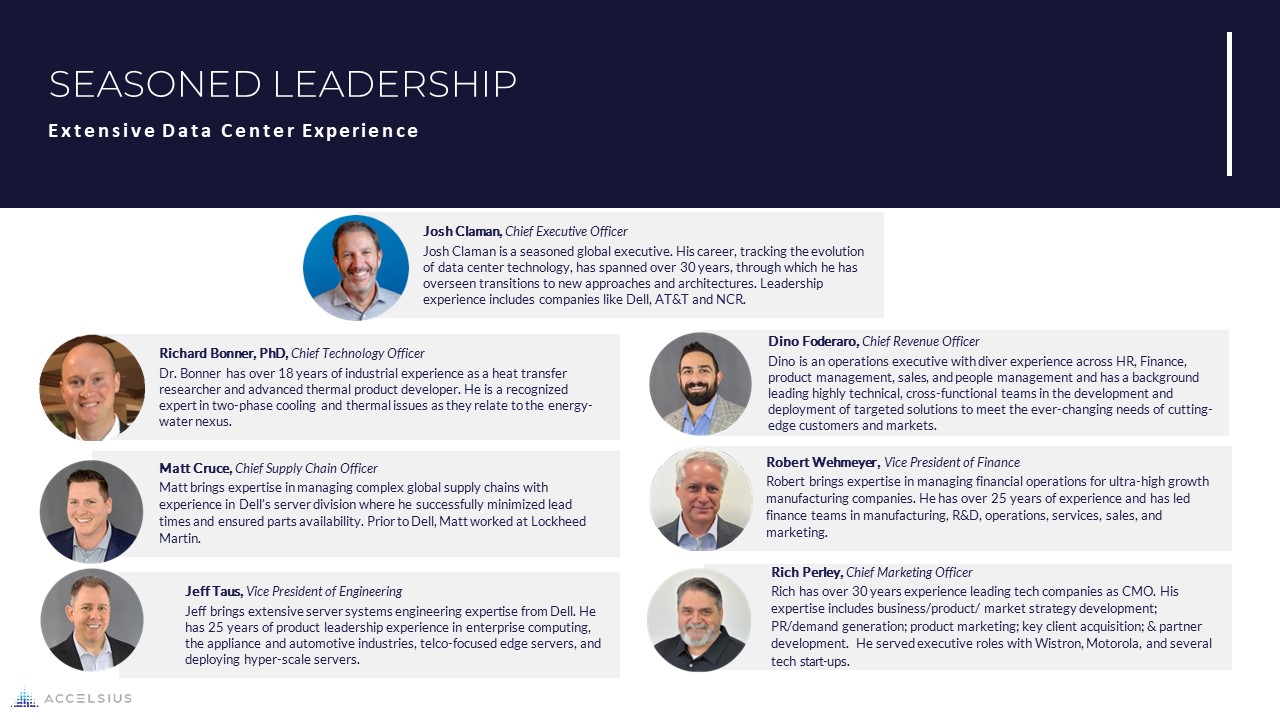

Dino Foderaro, Chief Revenue Officer Dino is an operations executive with diver

experience across HR, Finance, product management, sales, and people management and has a background leading highly technical, cross-functional teams in the development and deployment of targeted solutions to meet the ever-changing needs of

cutting- edge customers and markets. Robert Wehmeyer, Vice President of Finance Robert brings expertise in managing financial operations for ultra-high growth manufacturing companies. He has over 25 years of experience and has led finance

teams in manufacturing, R&D, operations, services, sales, and marketing. Jeff Taus, Vice President of Engineering Jeff brings extensive server systems engineering expertise from Dell. He has 25 years of product leadership experience in

enterprise computing, the appliance and automotive industries, telco-focused edge servers, and deploying hyper-scale servers. Josh Claman, Chief Executive Officer Josh Claman is a seasoned global executive. His career, tracking the evolution

of data center technology, has spanned over 30 years, through which he has overseen transitions to new approaches and architectures. Leadership experience includes companies like Dell, AT&T and NCR. Rich Perley, Chief Marketing

Officer Rich has over 30 years experience leading tech companies as CMO. His expertise includes business/product/ market strategy development; PR/demand generation; product marketing; key client acquisition; & partner development. He

served executive roles with Wistron, Motorola, and several tech start-ups. Richard Bonner, PhD, Chief Technology Officer Dr. Bonner has over 18 years of industrial experience as a heat transfer researcher and advanced thermal product

developer. He is a recognized expert in two-phase cooling and thermal issues as they relate to the energy- water nexus. Matt Cruce, Chief Supply Chain Officer Matt brings expertise in managing complex global supply chains with experience in

Dell’s server division where he successfully minimized lead times and ensured parts availability. Prior to Dell, Matt worked at Lockheed Martin. SEASONED LEADERSHIP Extensive Data Center Experience

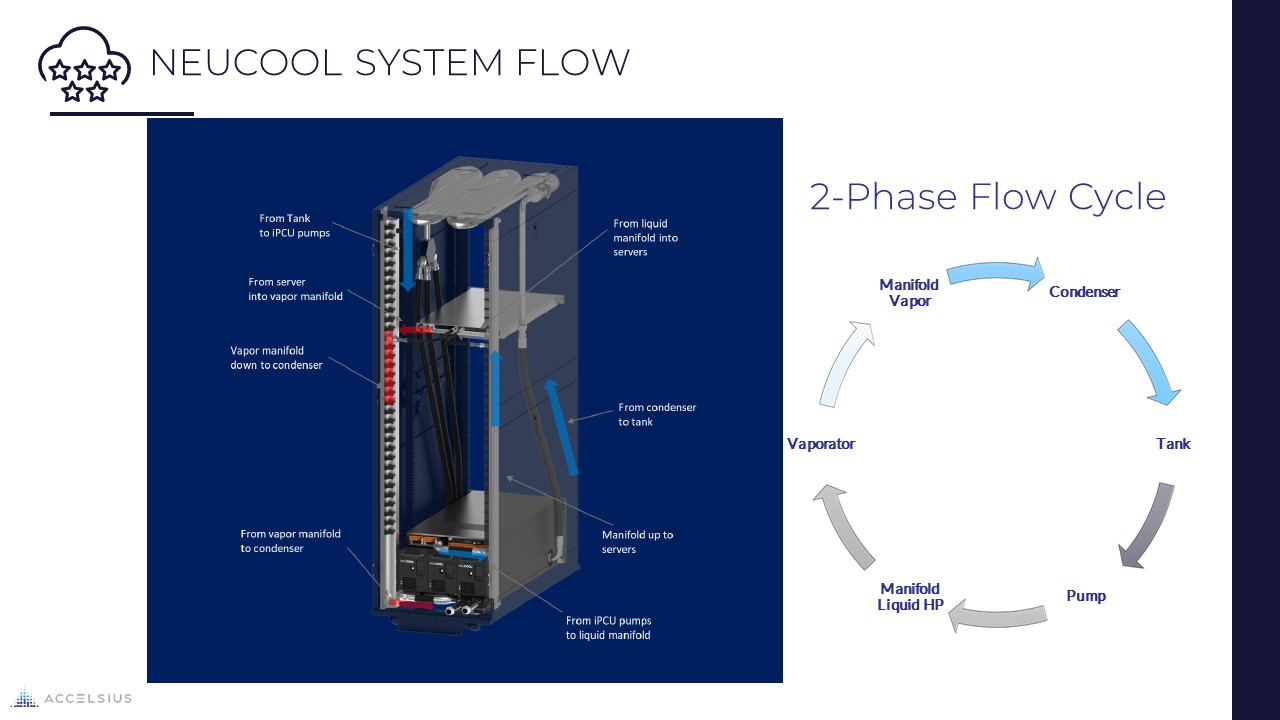

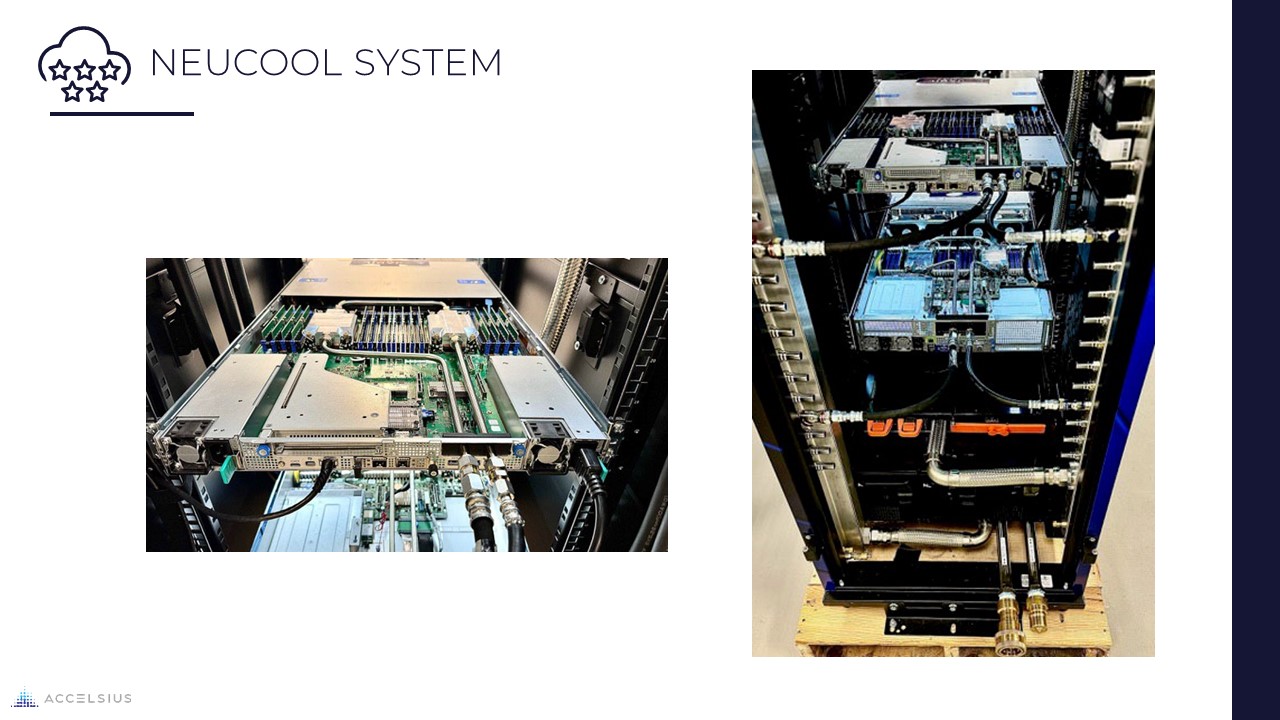

NEUCOOL SYSTEM FLOW Condenser Tank Pump Manifold Liquid

HP Vaporator Manifold Vapor 2-Phase Flow Cycle

NEUCOOL SYSTEM

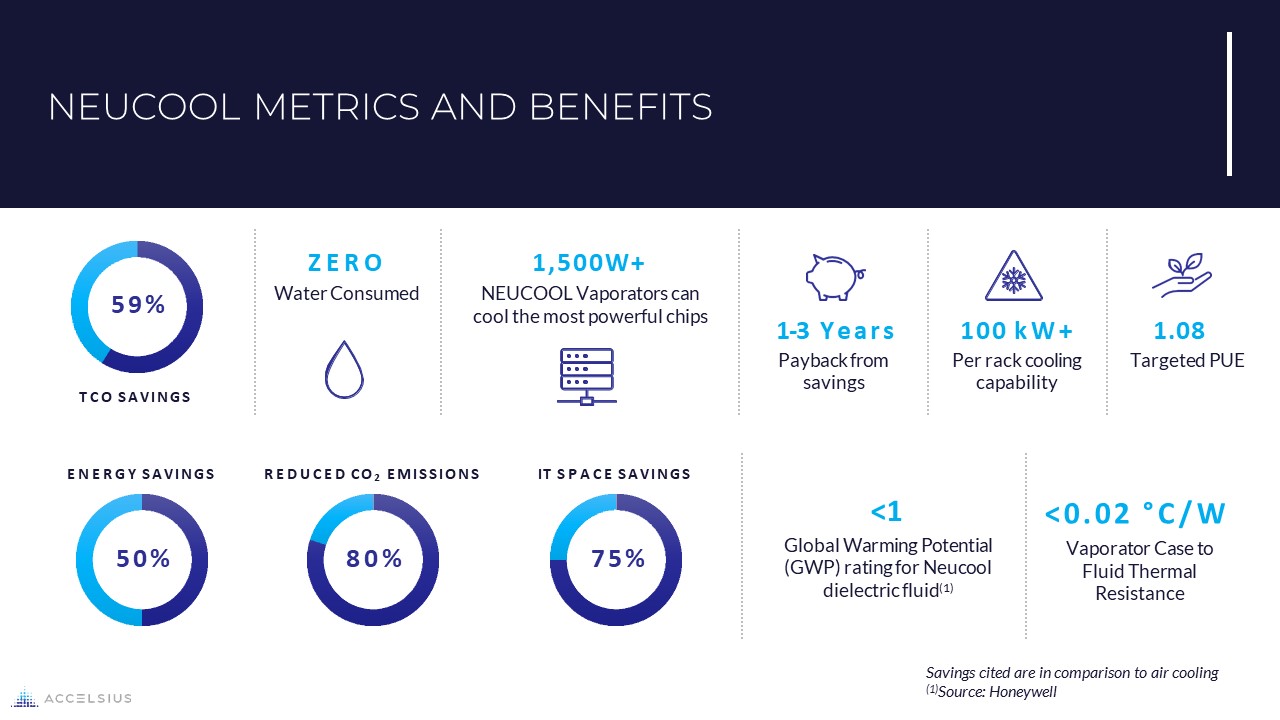

NEUCOOL METRICS AND BENEFITS TCO SAVINGS 59% ZERO Water

Consumed 1,500W+ NEUCOOL Vaporators can cool the most powerful chips 50% ENERGY SAVINGS 80% REDUCED CO2 EMISSIONS 75% IT SPACE SAVINGS 1-3 Years Payback from savings 100 kW+ Per rack cooling capability 1.08 Targeted PUE <0.02

°C/W Vaporator Case to Fluid Thermal Resistance <1 Global Warming Potential (GWP) rating for Neucool dielectric fluid(1) Savings cited are in comparison to air cooling (1)Source: Honeywell

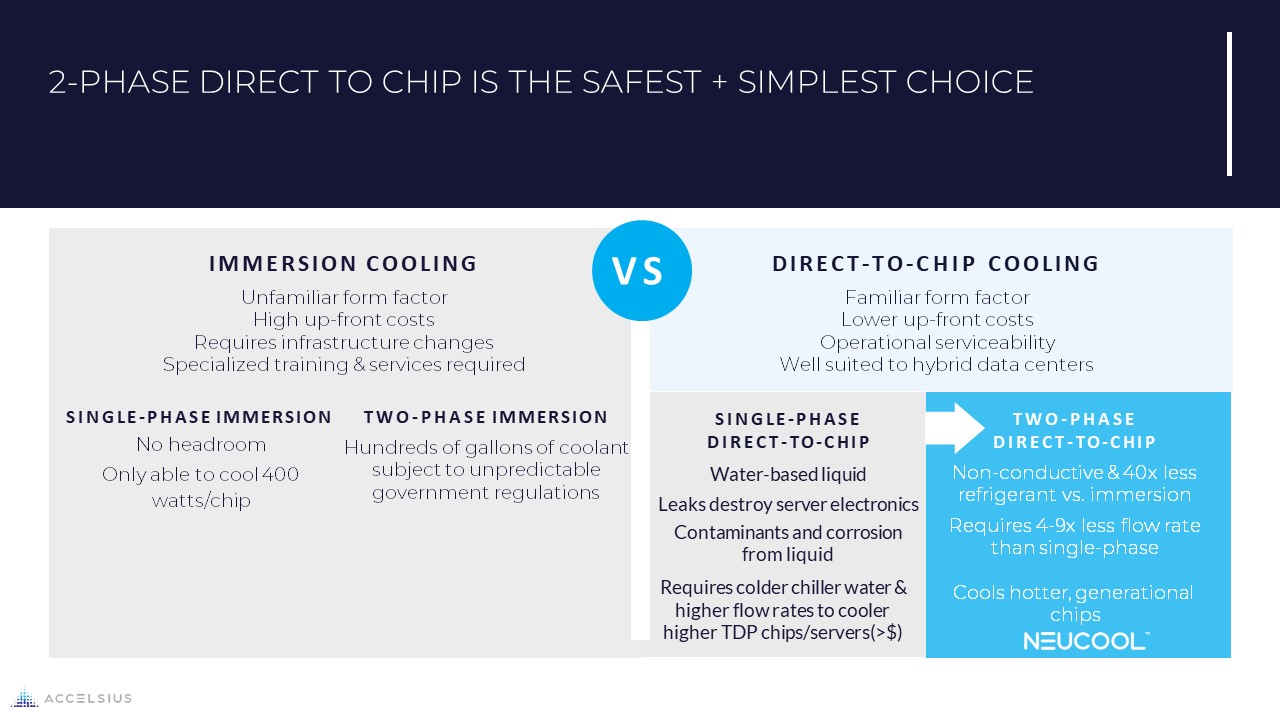

IMMERSION COOLING Unfamiliar form factor High up-front costs Requires

infrastructure changes Specialized training & services required No headroom Only able to cool 400 watts/chip SINGLE-PHASE IMMERSION TWO-PHASE IMMERSION Hundreds of gallons of coolant subject to unpredictable government

regulations DIRECT-TO-CHIP COOLING Familiar form factor Lower up-front costs Operational serviceability Well suited to hybrid data centers TWO-PHASE DIRECT-TO-CHIP Non-conductive & 40x less refrigerant vs. immersion Requires 4-9x less

flow rate than single-phase Cools hotter, generational chips SINGLE-PHASE DIRECT-TO-CHIP Water-based liquid Leaks destroy server electronics Contaminants and corrosion from liquid Requires colder chiller water & higher flow rates to

cooler higher TDP chips/servers(>$) 2-PHASE DIRECT TO CHIP IS THE SAFEST + SIMPLEST CHOICE VS

ACCELSIUS NEUCOOL: THE BEST OVERALL THERMAL PERFORMANCE Greatest Lifetime

Value Air (1U) 1P Immersion 2P Immersion 1P Direct-to-Chip 2P Direct-to-Chip / NeuCool Max TDP Cooled with 30°C Facility Water and Below Thermal Resistances 165 watts 190 watts 415 watts 700 watts (@2.2 LPM) 1000 watts (@.5

LPM) Thermal Resistance (Watts/°C) 0.15 0.13 0.06 0.03 0.015 Volume of Two-Phase Coolant N/A N/A 1,300 liters ($100+K) N/A 30 liters Flow rate required to cool 500-watt CPU N/A N/A N/A 2.2 LPM (assuming 4°C ΔT ) 0.18

LPM (assuming 0.7 vapor quality) % of server heat removed (Up to max TDP cooled) 100% 100% 100% 80% 80% Cost $/Watt $3.21 $4.23 $1.53 $1.55 Sources: ASHRAE, The Green Grid, Analysis from Dell CTO Office, Accelsius Internal Tests,

Chilldyne, The Gannet Group

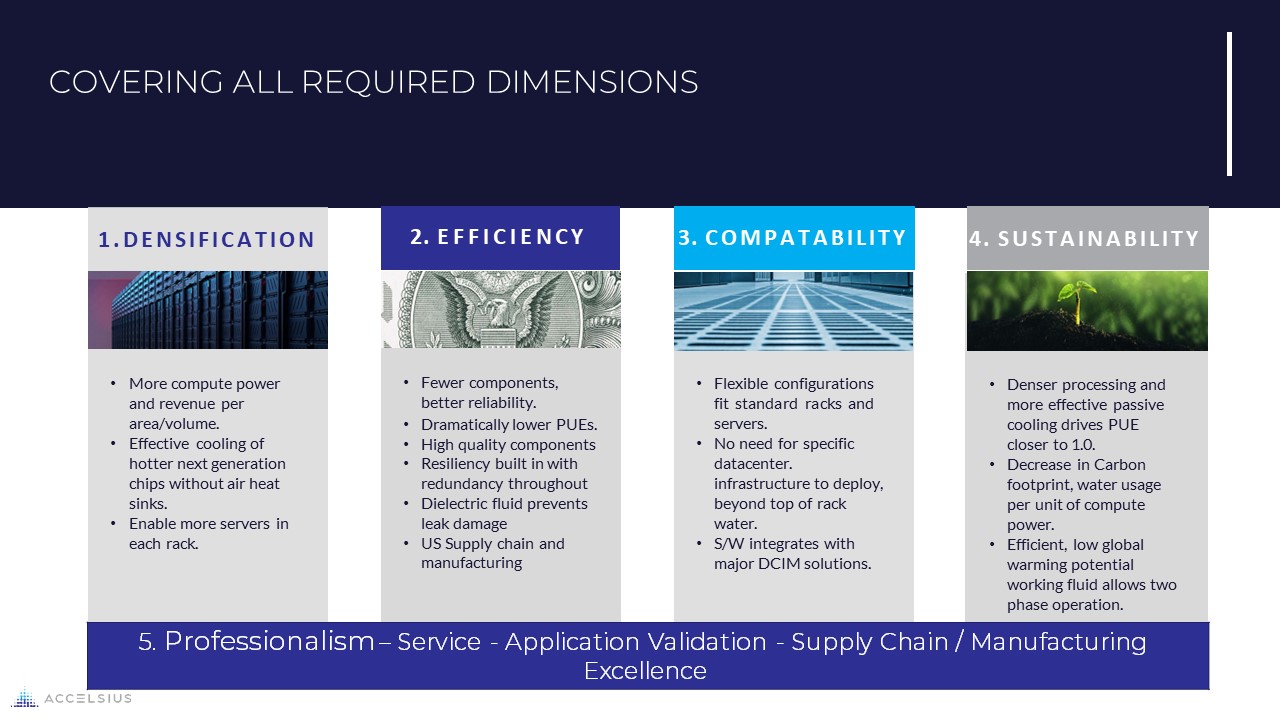

COVERING ALL REQUIRED DIMENSIONS DENSIFICATION More compute power and revenue

per area/volume. Effective cooling of hotter next generation chips without air heat sinks. Enable more servers in each rack. 2. EFFICIENCY 3. COMPATABILITY 4. SUSTAINABILITY Fewer components, better reliability. Dramatically lower

PUEs. High quality components Resiliency built in with redundancy throughout Dielectric fluid prevents leak damage US Supply chain and manufacturing Flexible configurations fit standard racks and servers. No need for specific datacenter.

infrastructure to deploy, beyond top of rack water. S/W integrates with major DCIM solutions. Denser processing and more effective passive cooling drives PUE closer to 1.0. Decrease in Carbon footprint, water usage per unit of compute

power. Efficient, low global warming potential working fluid allows two phase operation. 5. Professionalism – Service - Application Validation - Supply Chain / Manufacturing Excellence

MAKING QUICK TRACTION IN THE MARKET Signed Integrators and Service

Providers Servers Tested and Characterized Expanding VAR Agreements Strategic Relationships

Dave Yablunosky Chief Financial Officer Financial Model & Reporting

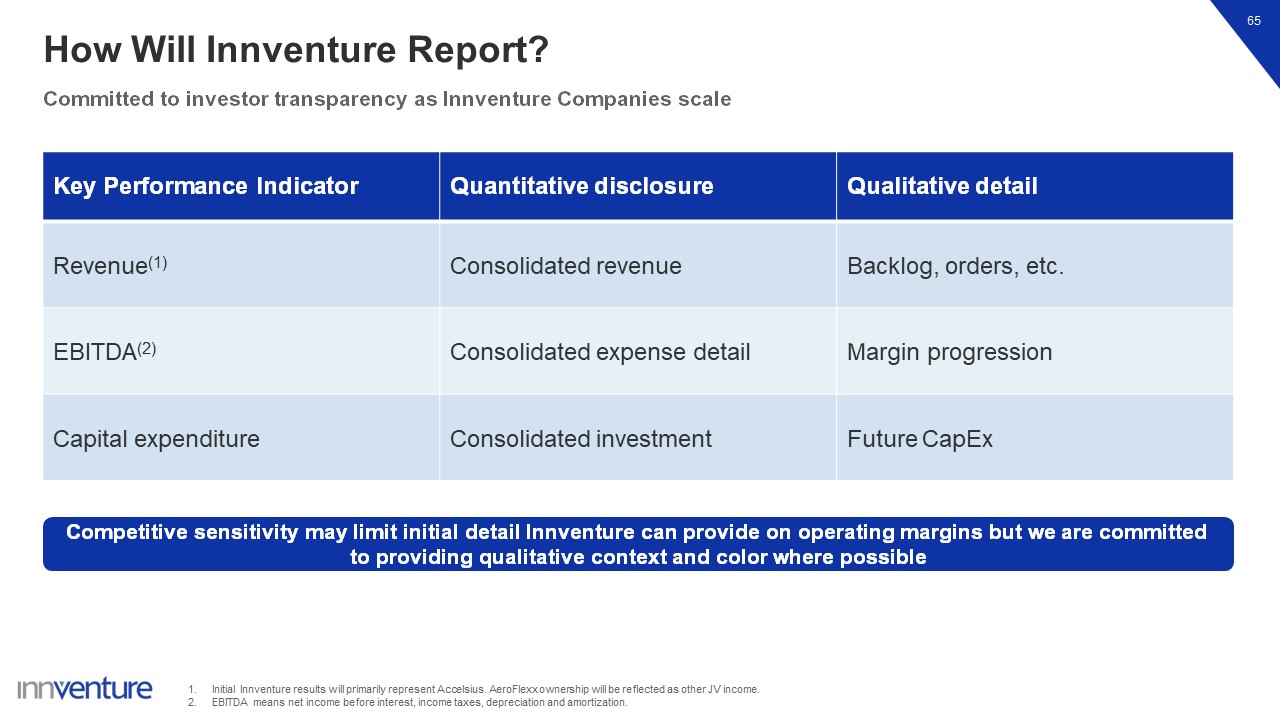

How Will Innventure Report? Committed to investor transparency as Innventure

Companies scale 65 Key Performance Indicator Quantitative disclosure Qualitative detail Revenue(1) Consolidated revenue Backlog, orders, etc. EBITDA(2) Consolidated expense detail Margin progression Capital expenditure Consolidated

investment Future CapEx Competitive sensitivity may limit initial detail Innventure can provide on operating margins but we are committed to providing qualitative context and color where possible Initial Innventure results will primarily

represent Accelsius. AeroFlexx ownership will be reflected as other JV income. EBITDA means net income before interest, income taxes, depreciation and amortization.

Key Tenets to Innventure’s Expected Financial Profile 66 Disciplined Capital

Expenditures Visible Path to Profitability Rapid Revenue Growth 1 2 3 A model of launching high-growth ventures with strong profitability metrics and substantial addressable markets

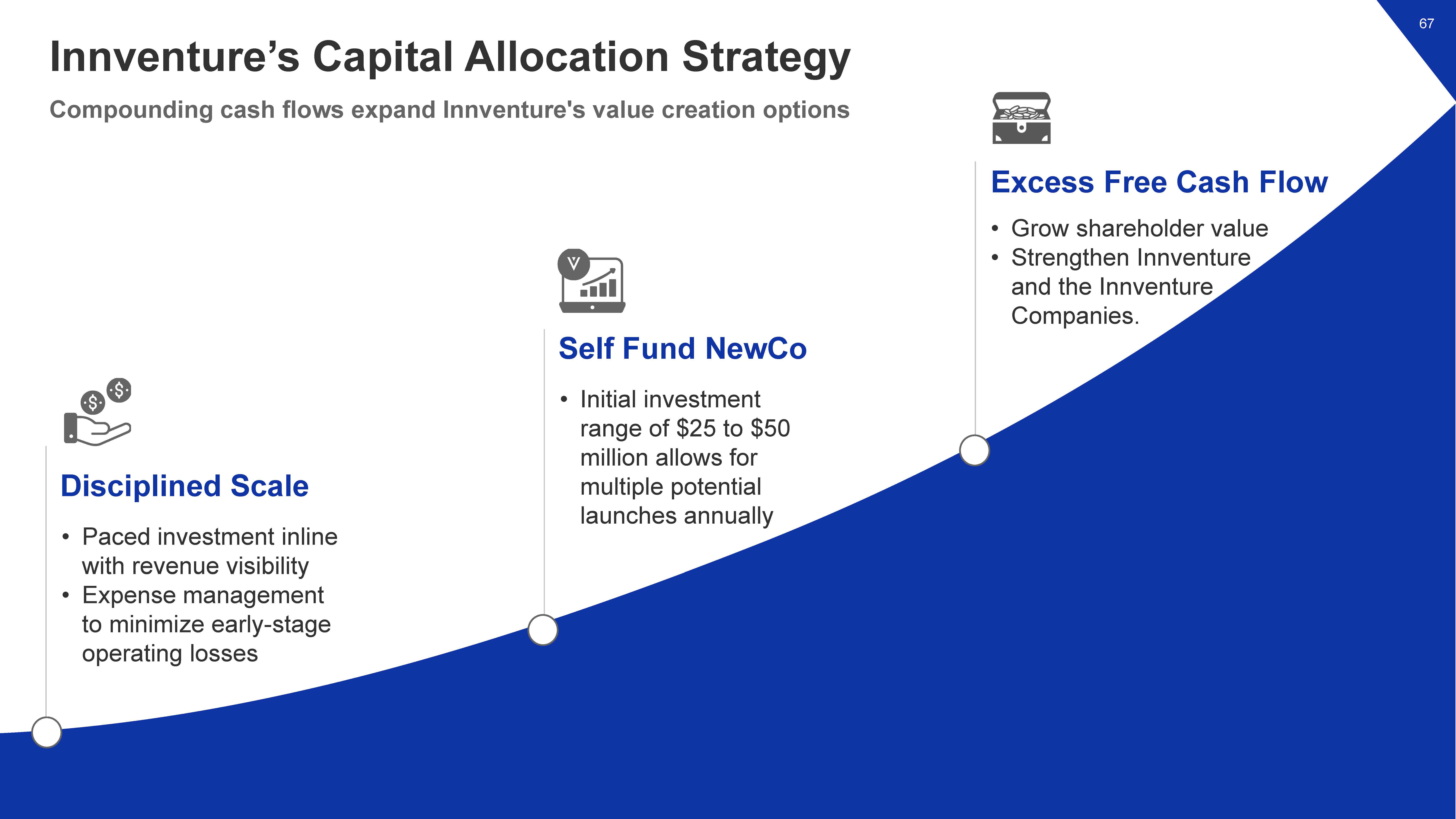

Compounding cash flows expand Innventure's value creation options • Paced investment inline with revenue visibility • Expense management to minimize early-stage

operating losses Disciplined Scale Self Fund NewCo • Initial investment range of $25 to $50 million allows for multiple potential launches annually Excess Free Cash Flow • Grow shareholder value • Strengthen Innventure and the Innventure

Companies. 67 Innventure’s Capital Allocation Strategy

Lucas Harper Chief Investment Officer Value Creation

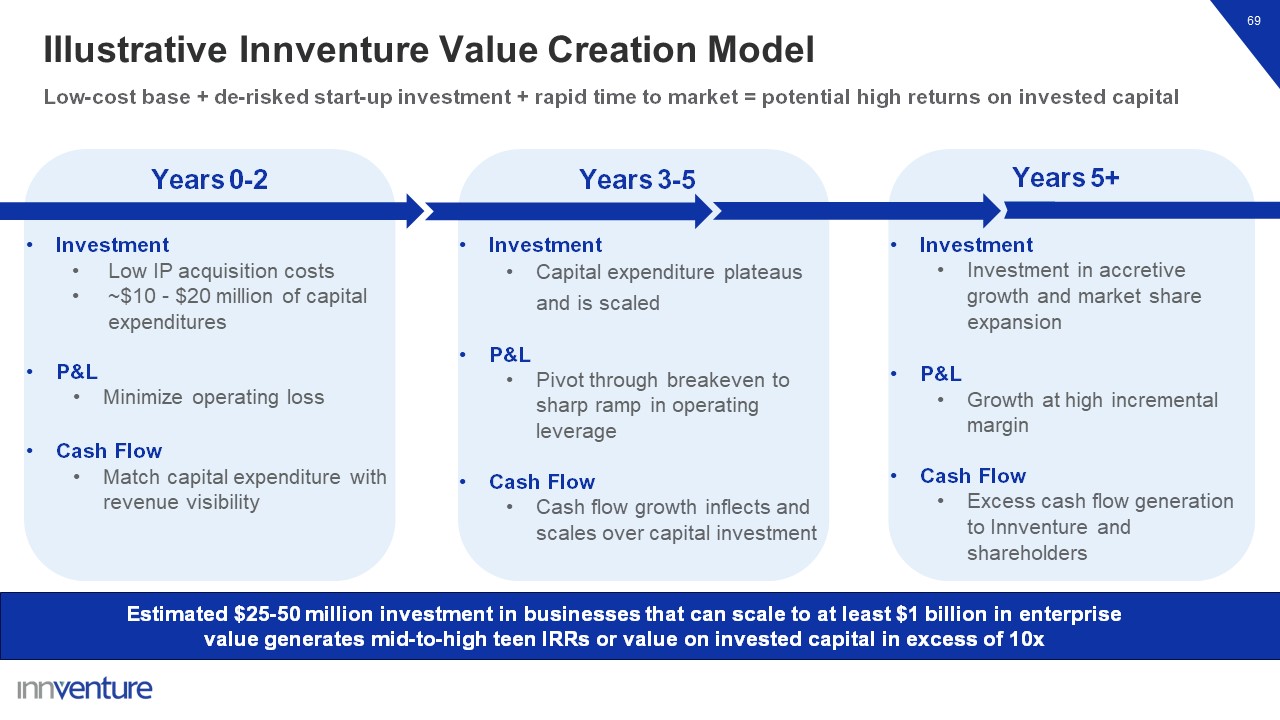

69 Low-cost base + de-risked start-up investment + rapid time to market =

potential high returns on invested capital Illustrative Innventure Value Creation Model Years 3-5 Years 0-2 Years 5+ Investment Low IP acquisition costs ~$10 - $20 million of capital expenditures P&L Minimize operating loss Cash

Flow Match capital expenditure with revenue visibility Investment Capital expenditure plateaus and is scaled P&L Pivot through breakeven to sharp ramp in operating leverage Cash Flow Cash flow growth inflects and scales over capital

investment Investment Investment in accretive growth and market share expansion P&L Growth at high incremental margin Cash Flow Excess cash flow generation to Innventure and shareholders Estimated $25-50 million investment in

businesses that can scale to at least $1 billion in enterprise value generates mid-to-high teen IRRs or value on invested capital in excess of 10x

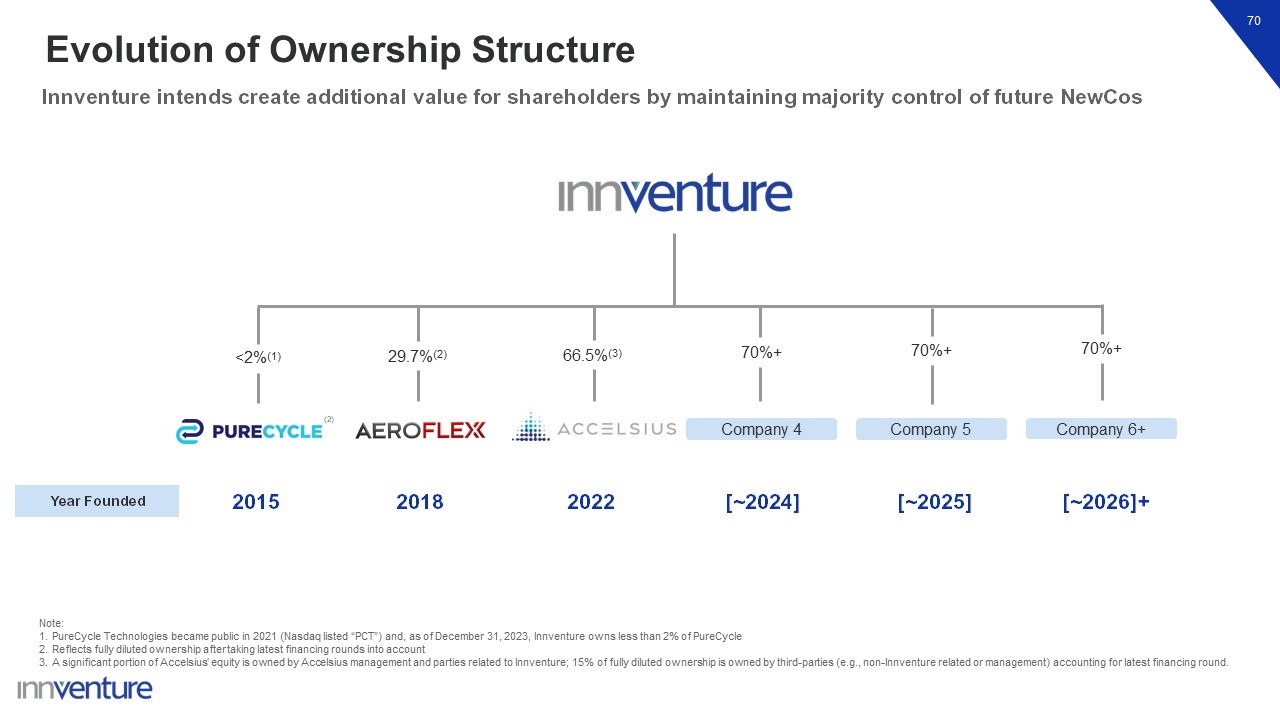

70 Innventure intends create additional value for shareholders by maintaining

majority control of future NewCos Evolution of Ownership Structure Year Founded 2015 2018 2022 [~2024] [~2025] [~2026]+ Note: PureCycle Technologies became public in 2021 (Nasdaq listed “PCT”) and, as of December 31, 2023, Innventure

owns less than 2% of PureCycle Reflects fully diluted ownership after taking latest financing rounds into account A significant portion of Accelsius’ equity is owned by Accelsius management and parties related to Innventure; 15% of fully

diluted ownership is owned by third-parties (e.g., non-Innventure related or management) accounting for latest financing round. Company 6+ Company 5 Company 4 (2) <2%(1) 29.7%(2) 66.5%(3) 70%+ 70%+ 70%+

Roland Austrup Capital Markets Valuation

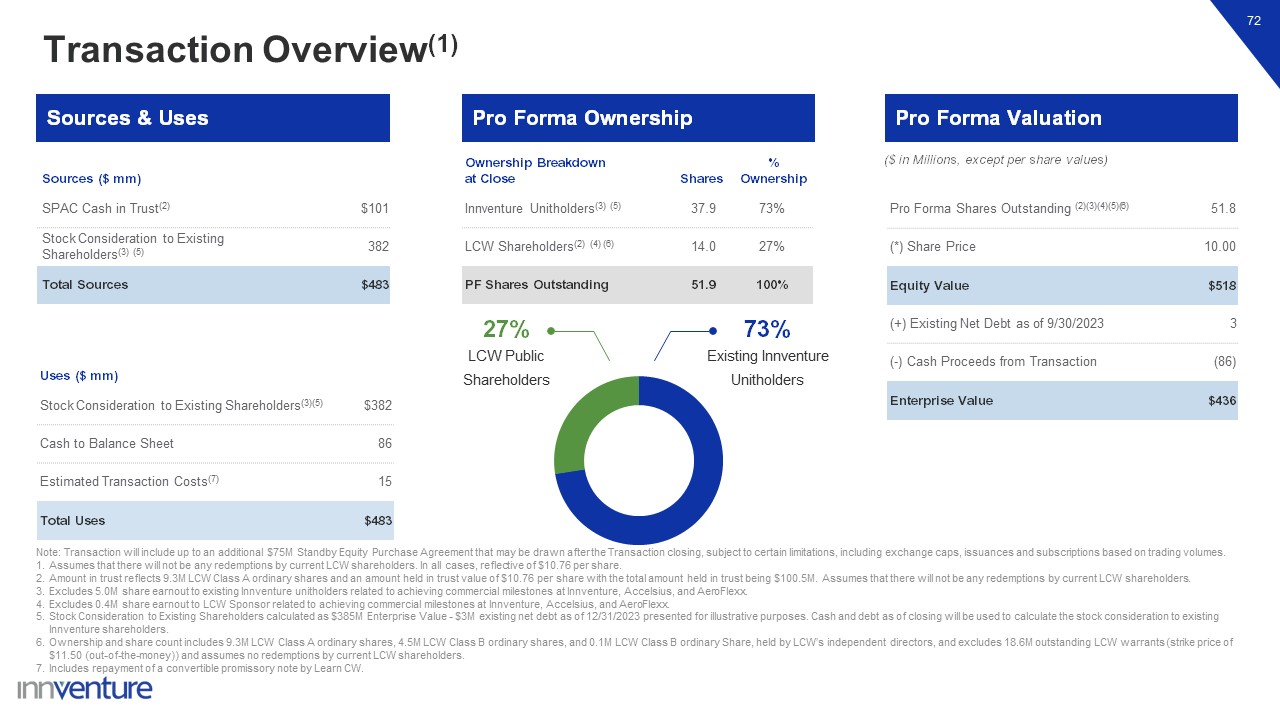

Pro Forma Valuation Pro Forma Ownership Sources & Uses 72 Sources ($

mm) SPAC Cash in Trust(2) $101 Stock Consideration to Existing Shareholders(3) (5) 382 Total Sources $483 Uses ($ mm) Stock Consideration to Existing Shareholders(3)(5) $382 Cash to Balance Sheet 86 Estimated Transaction

Costs(7) 15 Total Uses $483 Pro Forma Shares Outstanding (2)(3)(4)(5)(6) 51.8 (*) Share Price 10.00 Equity Value $518 (+) Existing Net Debt as of 9/30/2023 3 (-) Cash Proceeds from Transaction (86) Enterprise

Value $436 Ownership Breakdown at Close Shares % Ownership Innventure Unitholders(3) (5) 37.9 73% LCW Shareholders(2) (4) (6) 14.0 27% PF Shares Outstanding 51.9 100% ($ in Millions, except per share values) 73% Existing

Innventure Unitholders 27% LCW Public Shareholders Note: Transaction will include up to an additional $75M Standby Equity Purchase Agreement that may be drawn after the Transaction closing, subject to certain limitations, including exchange

caps, issuances and subscriptions based on trading volumes. Assumes that there will not be any redemptions by current LCW shareholders. In all cases, reflective of $10.76 per share. Amount in trust reflects 9.3M LCW Class A ordinary shares

and an amount held in trust value of $10.76 per share with the total amount held in trust being $100.5M. Assumes that there will not be any redemptions by current LCW shareholders. Excludes 5.0M share earnout to existing Innventure unitholders

related to achieving commercial milestones at Innventure, Accelsius, and AeroFlexx. Excludes 0.4M share earnout to LCW Sponsor related to achieving commercial milestones at Innventure, Accelsius, and AeroFlexx. Stock Consideration to Existing

Shareholders calculated as $385M Enterprise Value - $3M existing net debt as of 12/31/2023 presented for illustrative purposes. Cash and debt as of closing will be used to calculate the stock consideration to existing Innventure

shareholders. Ownership and share count includes 9.3M LCW Class A ordinary shares, 4.5M LCW Class B ordinary shares, and 0.1M LCW Class B ordinary Share, held by LCW’s independent directors, and excludes 18.6M outstanding LCW warrants (strike

price of $11.50 (out-of-the-money)) and assumes no redemptions by current LCW shareholders. Includes repayment of a convertible promissory note by Learn CW. Transaction Overview(1)

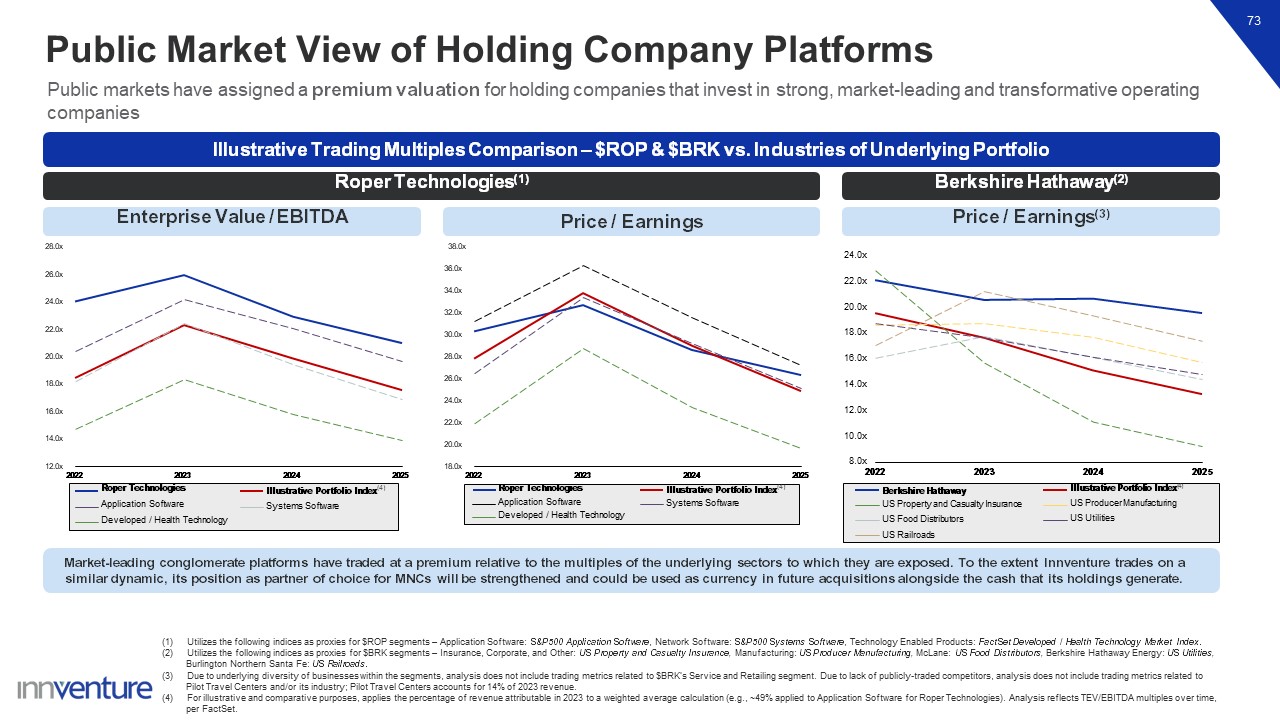

73 Public Market View of Holding Company Platforms Utilizes the following

indices as proxies for $ROP segments – Application Software: S&P500 Application Software, Network Software: S&P500 Systems Software, Technology Enabled Products: FactSet Developed / Health Technology Market Index. Utilizes the

following indices as proxies for $BRK segments – Insurance, Corporate, and Other: US Property and Casualty Insurance, Manufacturing: US Producer Manufacturing, McLane: US Food Distributors, Berkshire Hathaway Energy: US Utilities, Burlington

Northern Santa Fe: US Railroads. Due to underlying diversity of businesses within the segments, analysis does not include trading metrics related to $BRK’s Service and Retailing segment. Due to lack of publicly-traded competitors, analysis

does not include trading metrics related to Pilot Travel Centers and/or its industry; Pilot Travel Centers accounts for 14% of 2023 revenue. For illustrative and comparative purposes, applies the percentage of revenue attributable in 2023 to

a weighted average calculation (e.g., ~49% applied to Application Software for Roper Technologies). Analysis reflects TEV/EBITDA multiples over time, per FactSet. Market-leading conglomerate platforms have traded at a premium relative to the

multiples of the underlying sectors to which they are exposed. To the extent Innventure trades on a similar dynamic, its position as partner of choice for MNCs will be strengthened and could be used as currency in future acquisitions alongside

the cash that its holdings generate. Price / Earnings Berkshire Hathaway(2) Price / Earnings(3) Roper Technologies(1) Enterprise Value /

EBITDA 38.0x 18.0x 2022 20.0x 22.0x 24.0x 26.0x 28.0x 30.0x 32.0x 34.0x 36.0x 2023 2024 2025 Roper Technologies Application Software Developed / Health Technology Illustrative Portfolio Index(4) Systems

Software 12.0x 2022 14.0x 16.0x 18.0x 20.0x 22.0x 24.0x 26.0x 28.0x 2023 2024 2025 Roper Technologies Application Software Developed / Health Technology Illustrative Portfolio Index(4) Systems

Software 8.0x 10.0x 12.0x 14.0x 16.0x 18.0x 20.0x 22.0x 24.0x 2024 2025 2022 2023 Berkshire Hathaway US Property and Casualty Insurance US Food Distributors US Railroads Illustrative Portfolio Index(4) US Producer Manufacturing

US Utilities Public markets have assigned a premium valuation for holding companies that invest in strong, market-leading and transformative operating companies Illustrative Trading Multiples Comparison – $ROP & $BRK vs. Industries of

Underlying Portfolio

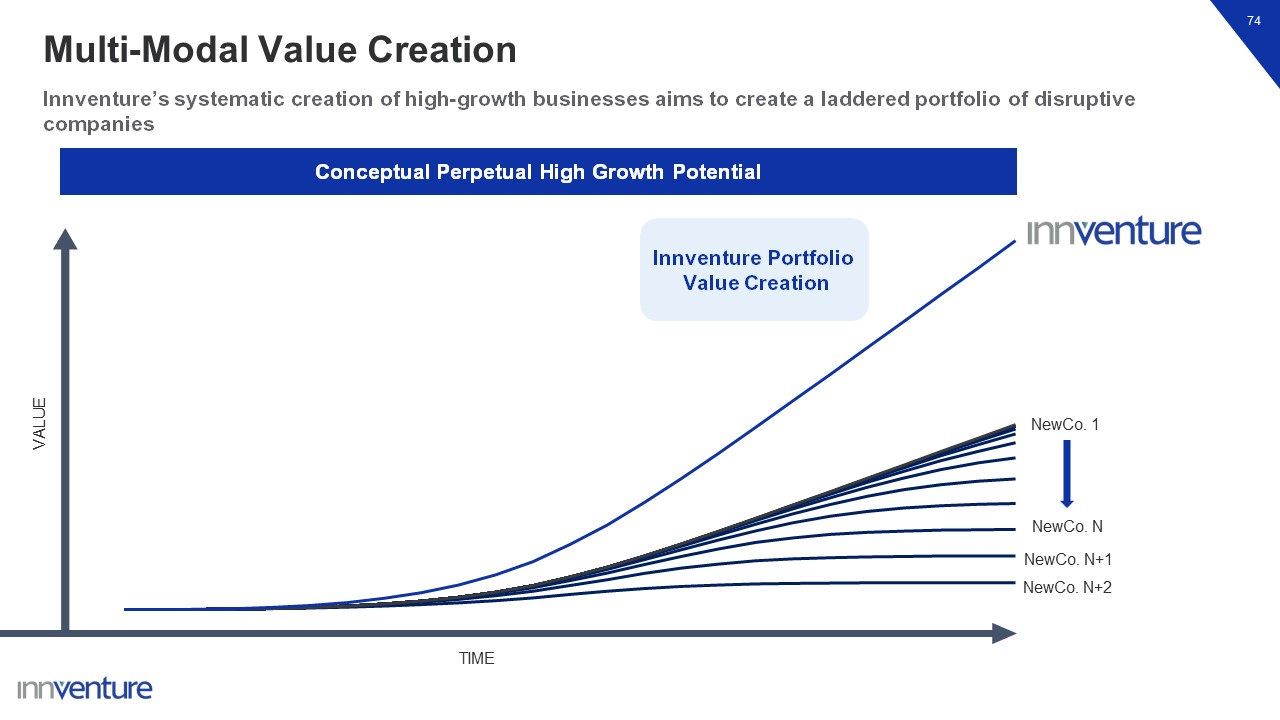

Multi-Modal Value Creation Innventure’s systematic creation of high-growth

businesses aims to create a laddered portfolio of disruptive companies 74 TIME VALUE Conceptual Perpetual High Growth Potential Innventure Portfolio Value Creation NewCo. N NewCo. N+1 NewCo. N+2 NewCo. 1

Q&A