“Interim Company Financials” has the meaning specified in Section 4.06(a).

“Interim Period” has the meaning specified in Section 6.01(a).

“Investor Rights Agreement” has the meaning specified in the Recitals.

“IPO” means the initial public offering of Parent Units pursuant to the IPO Prospectus.

“IPO Prospectus” means the final prospectus of the Parent, dated as of October 7, 2021 (File No. 333-254820).

“IRS” means the U.S. Internal Revenue Service (or any successor Governmental Authority).

“IT Assets” means all technology, devices, computers, hardware, Software (including firmware and middleware), systems, sites, servers, networks, workstations, routers, hubs, circuits, switches, interfaces, websites, platforms, data communications lines, and all other information or operational technology, telecommunications, or data processing assets, facilities, systems services, or equipment, and all data stored in such assets or processed by such assets, and all associated documentation owned or leased by, licensed to, or used by the Target Companies.

“JOBS Act” has the meaning specified in Section 5.06(e).

“Knowledge” with respect to: (i) the Company, means the knowledge of the individuals set forth on Section 10.01-B of the Company Disclosure Letter; and (ii) the Parent, means the knowledge of the individuals set forth on Section 10.01-C of the Parent Disclosure Letter, in each case, as such individuals would have acquired in the exercise of a reasonable inquiry of direct reports.

“Labor Agreement” has the meaning specified in Section 4.12(a)(x).

“Labor Union” has the meaning specified in Section 4.17(a).

“Law” means any federal, state, local, municipal, foreign or other constitution, law, statute, act, legislation, principle of common law, ordinance, code, edict, decree, proclamation, treaty, convention, rule, regulation, directive, requirement, writ, injunction, settlement, ordinance, regulation, Order or Consent, in each case, issued, enacted, adopted, passed, approved, promulgated, made, implemented or otherwise put into effect by or under the authority of any Governmental Authority.

“LCW Certificates of Merger” has the meaning specified in Section 1.02(a).

“LCW Group” has the meaning specified in Section 9.14(a)(i).

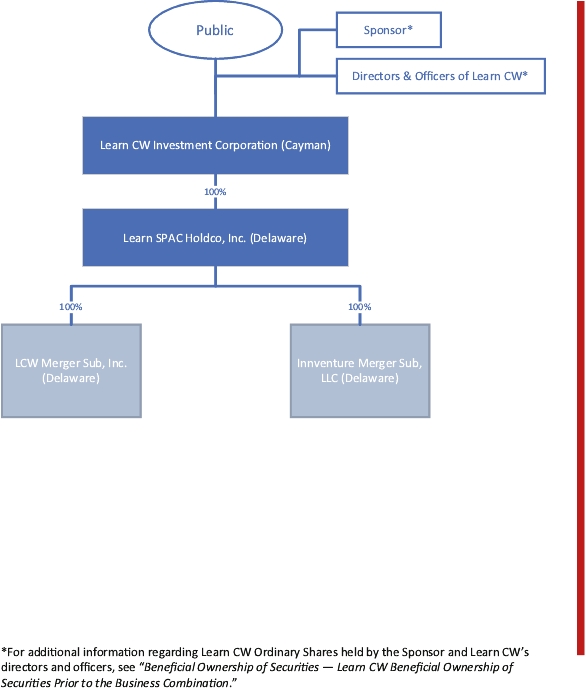

“LCW Merger” has the meaning specified in the Recitals.

“LCW Merger Effective Time” has the meaning specified in Section 1.02(a).

“LCW Merger Sub” has the meaning specified in the Preamble.

“Leased Real Property” has the meaning specified in Section 4.15(b).

“Legal Proceeding” means any notice of noncompliance or violation, or any claim, demand, charge, action, suit, litigation, audit, settlement, complaint, stipulation, assessment, examination, mediation or arbitration, or any request (including any request for information), inquiry, hearing, proceeding (whether at law or in equity) or investigation, by or before any Governmental Authority.

“Legally Privileged Communications” means all legally privileged communications made in connection with the negotiation, preparation, execution, delivery and performance under, or any dispute or Legal Proceeding arising out of or relating to, this Agreement, the Ancillary Documents, or the Transactions.

“Letter of Transmittal” has the meaning specified in Section 3.04(c).

“Liabilities” means all liabilities, Indebtedness, Legal Proceedings or obligations of any nature (whether absolute, accrued, contingent or otherwise, whether known or unknown, whether direct or indirect, whether matured or unmatured, whether due or to become due and whether or not required to be recorded or reflected on a balance sheet under GAAP or other applicable accounting standards).

“Lien” means any mortgage, pledge, deed of trust, lease, sublease, license, security interest, attachment, right of first refusal, option, proxy, voting trust, encumbrance, lien or charge of any kind whether consensual,